Lifestyle inflation, also known as lifestyle creep, is a common financial challenge where an increase in income leads to a proportional (or even higher) increase in spending. While it’s natural to want to improve your quality of life as you earn more, uncontrolled lifestyle inflation can prevent you from building wealth and achieving financial security. Many people find themselves in a never-ending cycle of earning more but still struggling with financial stress because their expenses rise alongside their income.

In this comprehensive guide, we will explore what lifestyle inflation is, why it happens, and, most importantly, how you can avoid it while keeping your finances in check. By following these practical steps, you can ensure that your financial growth leads to long-term security and freedom rather than just higher expenses.

Understanding Lifestyle Inflation

What is Lifestyle Inflation?

Lifestyle inflation occurs when individuals increase their spending as their income grows. Instead of saving, investing, or paying off debt, they use extra income to fund a more expensive lifestyle—larger homes, luxury cars, expensive vacations, and designer clothing.

For example, if you receive a 20% salary increase but your expenses also rise by 20% (or more), then you are not truly improving your financial situation. Instead, you’re maintaining the same financial stress level despite earning more.

Why Does Lifestyle Inflation Happen?

Several psychological and social factors contribute to lifestyle inflation:

- Social Pressure – People often feel the need to keep up with their peers, leading to unnecessary expenses on status symbols.

- Increased Comfort & Convenience – As income rises, individuals tend to justify spending more on luxuries and conveniences.

- Instant Gratification – The desire for immediate pleasure often leads to impulsive spending.

- Lack of Financial Awareness – Many people don’t track their expenses or have clear financial goals, making it easy to spend mindlessly.

- Marketing & Advertising Influence – Companies continuously promote the idea that higher income should lead to higher spending.

How to Avoid Lifestyle Inflation

Now that we understand lifestyle inflation, let’s explore effective strategies to avoid it and keep your finances in check.

1. Set Clear Financial Goals

Having well-defined financial goals will help you prioritize savings and investments over unnecessary spending. Your goals can be:

- Short-term goals: Building an emergency fund, paying off credit card debt, or saving for a vacation.

- Medium-term goals: Saving for a home down payment, starting a business, or funding higher education.

- Long-term goals: Retirement planning, achieving financial independence, or leaving a legacy for your children.

When you have a clear vision of what you want to achieve financially, it becomes easier to resist lifestyle inflation.

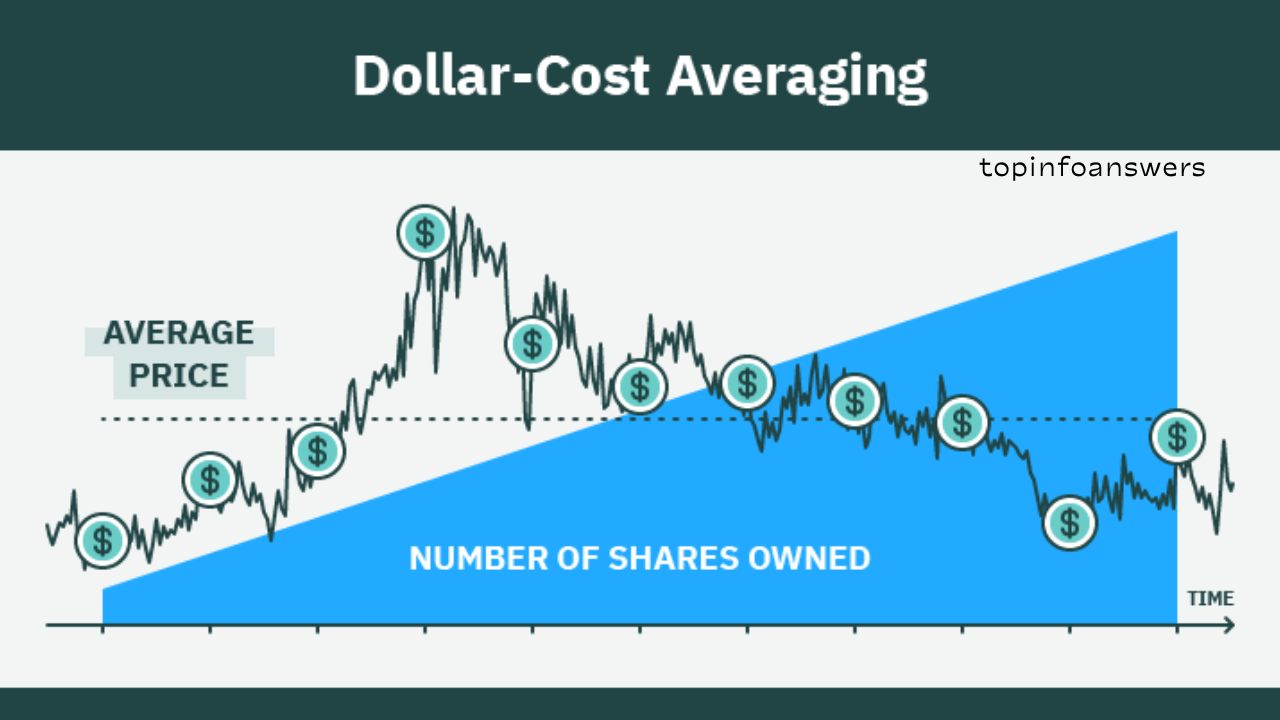

2. Increase Savings Before Expenses

A simple rule to avoid lifestyle inflation is: “Save first, spend later.”

Whenever you get a salary raise, tax refund, or bonus, allocate a significant portion to savings before considering any spending increases. You can:

- Increase your retirement contributions.

- Put more money into an emergency fund.

- Invest in stocks, mutual funds, or real estate.

By prioritizing savings, you automatically limit the amount available for lifestyle upgrades.

3. Follow the 50/30/20 Budget Rule

A practical way to maintain financial discipline is by following the 50/30/20 budgeting rule:

- 50% on needs (rent, groceries, utilities, insurance, etc.).

- 30% on wants (entertainment, dining out, travel, luxury items).

- 20% on savings and investments (retirement, emergency fund, debt repayment).

If your income increases, adjust the proportions so that savings grow rather than inflating your lifestyle.

4. Avoid Comparing Yourself to Others

The biggest trap leading to lifestyle inflation is the comparison game. Seeing friends, family, or colleagues upgrading their cars, homes, or lifestyles can create pressure to do the same.

However, remember:

- Their financial situation may be different.

- Many people fund their luxury lifestyle with debt.

- True financial success is about wealth accumulation, not high spending.

Stay focused on your own goals rather than competing with others.

5. Be Intentional with Major Purchases

Before making any significant purchase, ask yourself:

- Do I really need this?

- Can I afford it without going into debt?

- Will this expense add long-term value to my life?

Instead of making impulse purchases, practice delayed gratification—wait at least 30 days before buying expensive items. This helps eliminate unnecessary spending.

6. Maintain a Modest Lifestyle

Just because you can afford something doesn’t mean you should buy it. Some of the wealthiest people in the world live frugally despite having millions or even billions.

- Drive a reliable car instead of upgrading to a luxury model.

- Continue living in an affordable home rather than buying a mansion.

- Cook at home instead of dining at expensive restaurants every day.

A modest lifestyle allows you to build wealth while avoiding financial stress.

7. Automate Your Savings and Investments

To prevent spending temptations, automate your financial plan:

- Set up automatic transfers to your savings and investment accounts.

- Increase your 401(k) or retirement contributions whenever your salary increases.

- Use financial apps to track and manage expenses.

This method ensures that a portion of your income is saved before you even have the chance to spend it.

8. Avoid Unnecessary Debt

Debt can fuel lifestyle inflation by giving you access to money you don’t actually have. Avoid financing unnecessary expenses with credit cards or personal loans.

- Limit credit card usage to essential expenses.

- Pay off debts aggressively rather than accumulating new ones.

- Use cash or debit cards for discretionary spending.

By reducing your reliance on debt, you maintain better financial control.

9. Increase Income Without Increasing Expenses

Earning more money doesn’t mean you have to spend more. If you get a salary raise or side hustle income:

- Invest in income-generating assets.

- Pay off debt faster.

- Build a stronger financial cushion.

Keeping expenses stable while increasing income leads to true financial growth.

10. Practice Gratitude and Contentment

Lifestyle inflation often arises from a constant desire for more. Practicing gratitude helps shift focus from what you lack to what you already have.

- Appreciate small joys instead of chasing expensive thrills.

- Find happiness in experiences rather than material possessions.

- Remind yourself of financial security’s long-term benefits over short-term luxuries.

By cultivating contentment, you’ll naturally curb unnecessary spending.

How to Keep Your Finances in Check

Beyond avoiding lifestyle inflation, here are some additional tips to maintain financial discipline:

1. Track Your Expenses Regularly

Use budgeting apps like YNAB, Mint, or PocketGuard to monitor where your money goes. Keeping track helps identify wasteful spending.

2. Create Multiple Income Streams

Relying on one source of income can be risky. Diversify your earnings through:

- Side hustles

- Freelancing

- Investments (stocks, real estate, etc.)

3. Conduct Annual Financial Reviews

At least once a year, review your finances to assess:

- Savings progress

- Investment growth

- Spending habits

Adjust your budget and financial goals accordingly.

4. Educate Yourself on Personal Finance

Continuous learning will empower you to make better financial decisions. Read books, listen to finance podcasts, and follow reputable financial advisors.

5. Build an Emergency Fund

Having 3-6 months’ worth of expenses in an emergency fund prevents financial setbacks due to unexpected situations.

Lifestyle inflation is a silent wealth killer that can keep you stuck in a financial rat race despite higher earnings. However, by implementing intentional spending, setting clear financial goals, and prioritizing savings, you can break free from this cycle.

True financial success is not about how much you earn but how well you manage your money. By avoiding lifestyle inflation, practicing mindful spending, and focusing on long-term wealth-building, you can achieve financial freedom and security.

Stay disciplined, stay focused, and watch your financial future flourish!