An economic crisis can create significant financial hardship, affecting businesses, employees, and investors alike. However, individuals and families who build financial resilience can weather downturns more effectively. Financial resilience refers to the ability to withstand and recover from economic shocks, ensuring financial stability even during difficult times.

This guide explores strategies to build financial resilience, covering budgeting, income diversification, savings, debt management, investment strategies, and mental preparedness.

1. Understanding Financial Resilience

Financial resilience is the capacity to absorb financial shocks without severe long-term consequences. It involves:

- Maintaining a strong financial foundation

- Developing multiple income sources

- Managing debts wisely

- Preparing for unexpected expenses

- Adjusting financial strategies based on economic conditions

By adopting proactive measures, individuals can ensure they remain financially secure even during uncertain economic times.

2. Strengthening Your Budgeting and Spending Habits

A budget is the foundation of financial stability. During an economic crisis, revising and optimizing your budget is crucial.

A. Track Your Income and Expenses

Understanding your cash flow helps in making informed financial decisions. Track all sources of income and list necessary expenses such as rent, utilities, food, and loan payments.

B. Prioritize Essential Expenses

Cut back on non-essential spending, such as luxury items, dining out, and subscriptions. Allocate funds to necessities and emergency savings instead.

C. Adopt the 50/30/20 Rule

If possible, structure your budget using this method:

- 50% for necessities (rent, food, healthcare)

- 30% for discretionary spending (entertainment, travel)

- 20% for savings and debt repayment

Adjust this ratio as needed during economic hardships, focusing on increasing savings and reducing discretionary expenses.

D. Use Budgeting Tools and Apps

Apps like Mint, YNAB (You Need A Budget), and PocketGuard help track expenses and set financial goals.

3. Building and Maintaining an Emergency Fund

An emergency fund provides a financial cushion during income loss or unexpected expenses.

A. How Much Should You Save?

Experts recommend saving 3 to 6 months’ worth of essential expenses in an easily accessible account.

B. How to Build an Emergency Fund

- Automate Savings: Set up automatic transfers to your emergency fund.

- Cut Unnecessary Expenses: Redirect money from non-essential spending.

- Use Windfalls Wisely: Save tax refunds, bonuses, or extra income instead of spending them.

C. Where to Keep Your Emergency Fund

- High-Yield Savings Accounts (for accessibility and interest earnings)

- Money Market Accounts

- Certificates of Deposit (CDs) (for longer-term emergencies)

4. Diversifying Income Streams

Relying on a single income source increases financial vulnerability during economic downturns. Developing multiple income streams can provide security.

A. Start a Side Business

- Sell products or services online through Etsy, Shopify, or Amazon.

- Offer freelance work in areas like graphic design, writing, or consulting (via platforms like Fiverr, Upwork, or Freelancer).

- Teach or tutor online using platforms like Udemy, Skillshare, or Preply.

B. Invest in Passive Income Sources

- Dividend Stocks: Invest in companies that pay regular dividends.

- Rental Income: Consider real estate investments for passive earnings.

- Peer-to-Peer Lending: Use platforms like LendingClub to earn interest on loans.

- Create Digital Products: Sell eBooks, courses, or printables.

C. Build Online Income Streams

- Start a YouTube channel and monetize through ads and sponsorships.

- Create a blog and earn through affiliate marketing and advertisements.

- Explore dropshipping and e-commerce.

5. Managing Debt Wisely

Debt can become a significant burden during an economic crisis. Managing and reducing debt enhances financial stability.

A. Prioritize High-Interest Debt

Focus on paying off high-interest debts like credit cards first.

B. Use the Debt Snowball or Debt Avalanche Method

- Debt Snowball: Pay off the smallest debts first to build momentum.

- Debt Avalanche: Pay off debts with the highest interest rates first to save on interest payments.

C. Negotiate with Creditors

If struggling to make payments, contact creditors to discuss lowering interest rates or deferring payments.

D. Consider Debt Consolidation

Consolidating debts into a single loan with a lower interest rate can simplify payments and reduce costs.

6. Smart Investing During an Economic Crisis

Investing wisely during economic downturns can help grow wealth over the long term.

A. Diversify Your Investments

- Invest in a mix of stocks, bonds, and real estate.

- Consider international markets to spread risk.

B. Focus on Defensive Stocks

Companies in essential industries (healthcare, utilities, consumer staples) tend to be more stable during economic downturns.

C. Take Advantage of Market Declines

Economic crises often present buying opportunities for long-term investors. Invest in strong, undervalued companies at discounted prices.

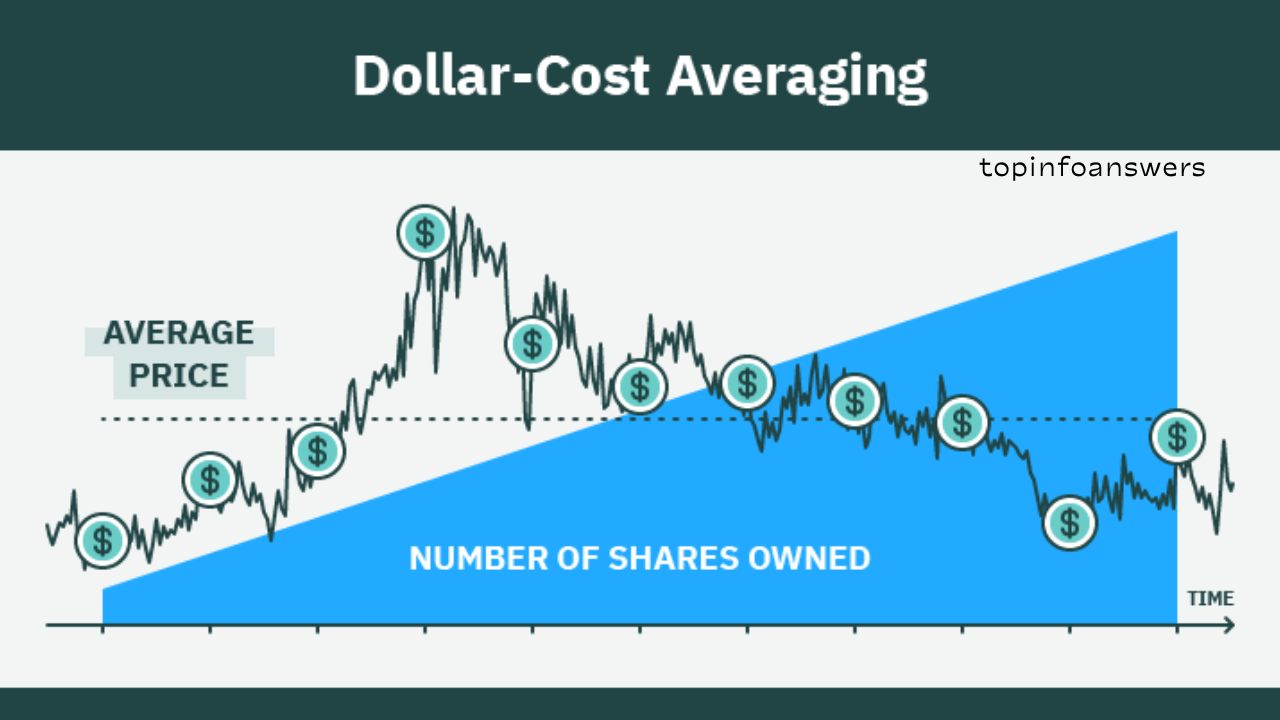

D. Continue Dollar-Cost Averaging

Investing a fixed amount at regular intervals reduces the impact of market volatility.

E. Keep a Long-Term Perspective

Market fluctuations are normal. Avoid panic selling and focus on long-term financial goals.

7. Protecting Yourself with Insurance

Insurance helps mitigate financial risks during crises.

A. Health Insurance

Ensure you have adequate health coverage to avoid high medical expenses.

B. Life Insurance

Provides financial security to dependents in case of unexpected events.

C. Disability Insurance

Protects your income if you’re unable to work due to illness or injury.

D. Home and Auto Insurance

Make sure policies cover potential risks, such as property damage or accidents.

8. Strengthening Your Financial Knowledge

Staying informed about financial strategies helps in making better decisions.

A. Read Personal Finance Books and Blogs

Some recommended books include:

- The Total Money Makeover by Dave Ramsey

- Rich Dad Poor Dad by Robert Kiyosaki

- Your Money or Your Life by Vicki Robin

B. Follow Financial Experts

Stay updated through finance-related YouTube channels, podcasts, and social media accounts.

C. Take Online Courses

Platforms like Coursera, Udemy, and Khan Academy offer personal finance courses.

9. Developing a Crisis Mindset and Mental Resilience

Financial resilience isn’t just about numbers—it also requires mental preparedness.

A. Stay Positive and Proactive

Focus on solutions rather than dwelling on problems.

B. Be Adaptable

Be open to career changes, learning new skills, and adjusting financial strategies.

C. Build a Support Network

Seek financial advice from mentors, join community groups, or participate in financial literacy programs.

D. Practice Mindful Spending

Differentiate between wants and needs to develop better financial habits.

10. Government and Community Assistance Programs

During economic downturns, governments often provide financial relief programs.

A. Research Available Programs

- Unemployment benefits

- Food assistance programs (e.g., SNAP)

- Small business grants and loans

- Tax relief measures

B. Utilize Local Resources

Community programs, food banks, and non-profits often provide financial assistance and job support.

Building financial resilience during an economic crisis requires proactive planning, disciplined budgeting, diversified income sources, debt management, and long-term investing. By implementing these strategies, individuals can secure their financial future, reduce stress, and emerge stronger from economic downturns.

Taking small, consistent steps today can lead to financial stability and peace of mind, regardless of economic conditions.