Investing for short-term goals requires a different approach compared to long-term investing. Unlike long-term investments, where you can tolerate market fluctuations and volatility, short-term investments demand stability, liquidity, and low risk. Whether you are saving for a vacation, a down payment on a house, an emergency fund, or any other financial goal within the next few years, you need investment options that provide capital preservation and steady returns.

This guide will walk you through various strategies and investment options for short-term goals while ensuring low risk.

Understanding Short-Term Investing

Short-term investing refers to placing your money in financial instruments with a time horizon of less than five years. The main objectives of short-term investing are:

- Preserving capital: Protecting your money from significant losses.

- Ensuring liquidity: Being able to access your funds when needed.

- Generating stable returns: Earning reasonable returns without excessive risk.

Given these objectives, short-term investors should avoid high-volatility assets like individual stocks or cryptocurrencies, as these can experience sharp price fluctuations. Instead, they should focus on safe and liquid investment vehicles.

Factors to Consider for Short-Term Investments

Before selecting the right investment option, consider these factors:

1. Time Horizon

- If you need the money within 6–12 months, opt for investments that offer high liquidity and zero risk, such as savings accounts and money market funds.

- If your goal is 1–3 years away, consider low-risk fixed-income investments like bonds and fixed deposits.

- For a 3–5 year timeframe, you can take slightly more risk by investing in balanced mutual funds or corporate bonds.

2. Liquidity

You should be able to withdraw your money easily without facing penalties or losses. Avoid investments with lock-in periods or withdrawal restrictions.

3. Risk Tolerance

Short-term investments should have low risk to avoid losing capital. Avoid volatile assets such as stocks, cryptocurrencies, or long-term bonds.

4. Return on Investment (ROI)

While safety is the priority, your investments should still generate reasonable returns to outpace inflation.

Best Low-Risk Investment Options for Short-Term Goals

1. High-Yield Savings Accounts

- Best for: Emergency funds, short-term savings

- Risk Level: Very low

- Liquidity: High

- Expected Returns: 3% – 5% per year

High-yield savings accounts offer a safe place to store money while earning interest. They are FDIC-insured (up to $250,000 per account in the U.S.), meaning your funds are protected. These accounts provide instant access to your money and ensure capital preservation.

Pros:

✅ No risk of losing money

✅ Easily accessible

✅ FDIC or government-backed insurance

Cons:

❌ Interest rates may fluctuate

❌ Returns may not always beat inflation

2. Fixed Deposits (FDs) and Certificates of Deposit (CDs)

- Best for: Goals within 1–3 years

- Risk Level: Low

- Liquidity: Moderate (penalties for early withdrawal)

- Expected Returns: 4% – 7% per year

Fixed deposits (FDs) and certificates of deposit (CDs) are low-risk investments where you deposit a lump sum for a fixed tenure (3 months, 6 months, 1 year, etc.) at a predetermined interest rate. The returns are guaranteed, making them ideal for short-term goals.

Pros:

✅ Guaranteed returns

✅ No market volatility

✅ FDIC or bank-backed security

Cons:

❌ Early withdrawal penalties

❌ Inflation may erode real returns

3. Money Market Funds

- Best for: Short-term parking of cash

- Risk Level: Very low

- Liquidity: High

- Expected Returns: 3% – 6% per year

Money market funds invest in highly liquid, short-term debt instruments, such as Treasury bills, commercial paper, and certificates of deposit. These funds offer higher interest than regular savings accounts while maintaining liquidity and safety.

Pros:

✅ Low risk

✅ Higher returns than traditional savings

✅ Easy access to funds

Cons:

❌ Returns are not fixed

❌ Subject to inflation risk

4. Treasury Bills (T-Bills) and Government Bonds

- Best for: Risk-free investment with short-term goals

- Risk Level: Very low (government-backed)

- Liquidity: Moderate to high

- Expected Returns: 4% – 7% per year

Treasury Bills (T-Bills) and government bonds are among the safest investment options as they are backed by the government. T-Bills have short maturities (3 months to 1 year), while government bonds can range from 1 year to 5 years.

Pros:

✅ Virtually risk-free

✅ Higher returns than savings accounts

✅ Highly liquid

Cons:

❌ Returns are lower compared to corporate bonds

❌ May not be suitable for ultra-short-term goals

5. Short-Term Bond Funds

- Best for: Investors looking for higher yields with low risk

- Risk Level: Low

- Liquidity: Moderate to high

- Expected Returns: 5% – 8% per year

Short-term bond funds invest in low-risk bonds with shorter maturities (1–3 years), such as corporate bonds, municipal bonds, and government securities. These funds provide higher yields than money market funds while maintaining low risk.

Pros:

✅ Higher returns than savings accounts and FDs

✅ Low volatility compared to stocks

✅ Diversification reduces risk

Cons:

❌ Slight interest rate risk

❌ May involve small fluctuations in value

6. Ultra Short-Term Debt Funds

- Best for: Investors with a 6-month to 2-year time frame

- Risk Level: Low

- Liquidity: High

- Expected Returns: 5% – 7% per year

Ultra short-term debt funds invest in high-quality debt securities with maturities ranging from 3 months to 1 year. These funds offer better returns than fixed deposits while keeping risk minimal.

Pros:

✅ Higher returns than money market funds

✅ Low volatility

✅ Suitable for short-term goals

Cons:

❌ Slight risk of interest rate fluctuations

❌ Not FDIC-insured

7. Recurring Deposits (RDs)

- Best for: Investors who want to save small amounts monthly

- Risk Level: Very low

- Liquidity: Moderate

- Expected Returns: 4% – 6% per year

Recurring deposits allow you to invest small amounts monthly into a deposit account with a fixed interest rate. It is a great option for people who want to build savings gradually for short-term goals.

Pros:

✅ Guaranteed returns

✅ Helps build disciplined savings

✅ No market risk

Cons:

❌ Lower returns compared to debt funds

❌ Early withdrawal penalties

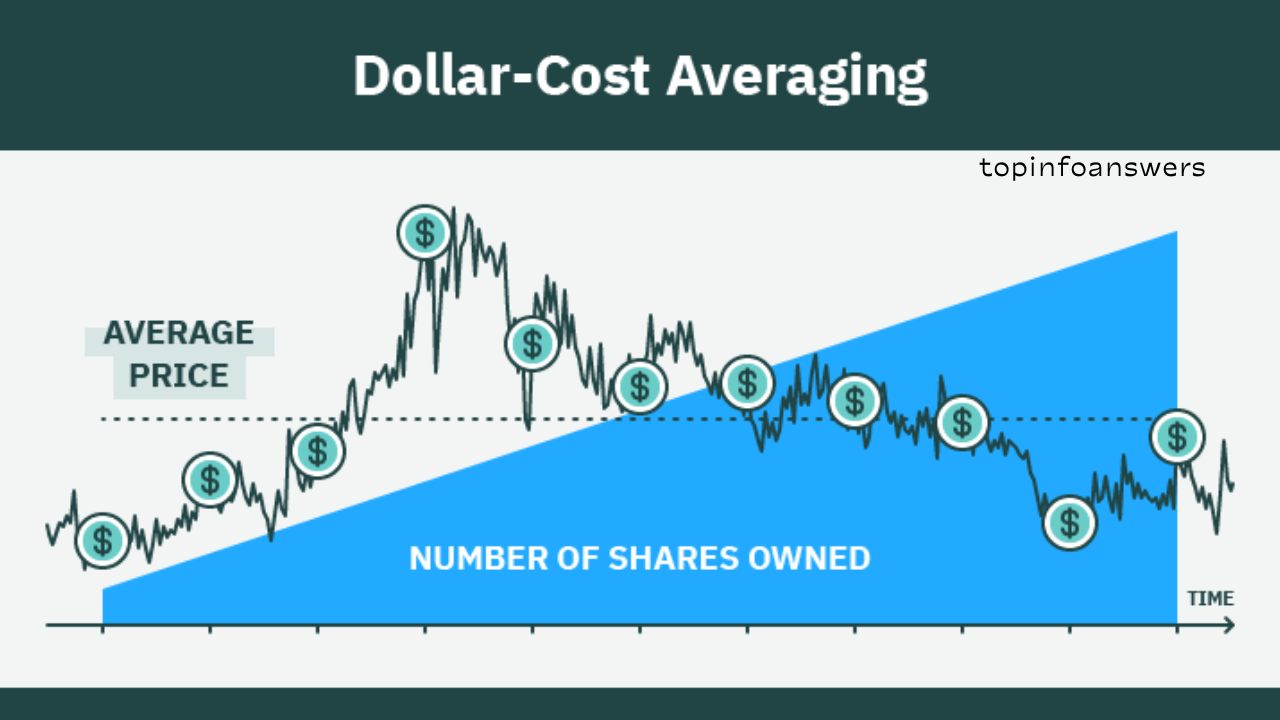

Best Short-Term Investment Strategies

1. Diversify Your Portfolio

Instead of putting all your money into one investment, spread your funds across multiple low-risk options like savings accounts, FDs, bond funds, and T-Bills to reduce risk.

2. Align Investments with Time Horizon

- Less than 1 year: Savings accounts, money market funds, T-Bills.

- 1–3 years: Fixed deposits, short-term bond funds.

- 3–5 years: Ultra short-term debt funds, balanced mutual funds.

3. Reinvest for Better Returns

If you have a 3-year timeframe, reinvest your returns in safe investments to maximize gains while maintaining low risk.

4. Avoid High-Risk Investments

Stay away from stocks, cryptocurrencies, and volatile assets. While they offer higher returns, they also come with high risk, which is unsuitable for short-term goals.

Final Thoughts

Investing for short-term goals requires a careful balance between safety, liquidity, and returns. The best investment depends on your time horizon, risk tolerance, and financial goals. Low-risk options like savings accounts, FDs, money market funds, and short-term bonds provide capital protection and stable returns.

By following a well-planned short-term investment strategy, you can ensure that your money grows safely and efficiently while being available when needed.