Your 30s are a crucial decade for financial growth and stability. By this time, you might have a steady job, increased income, or even started a family. However, financial missteps during this period can have long-lasting consequences. To ensure a secure future, you need to make smart financial decisions while avoiding common mistakes.

This guide explores strategies to minimize financial mistakes in your 30s, covering areas like budgeting, investing, debt management, retirement planning, and more.

1. Set Clear Financial Goals

One of the biggest mistakes people make in their 30s is not setting clear financial goals. Without a plan, you may end up spending recklessly and struggling later in life.

How to Set Financial Goals

- Short-term goals (1-3 years): Paying off credit card debt, building an emergency fund, or saving for a car.

- Medium-term goals (3-7 years): Buying a home, investing in education, or starting a business.

- Long-term goals (10+ years): Retirement savings, wealth accumulation, or achieving financial independence.

Tip: Write down your financial goals and create a roadmap for achieving them.

2. Create and Stick to a Budget

Budgeting is essential to managing your finances effectively. Without a budget, it’s easy to overspend and live paycheck to paycheck.

How to Create a Budget

- Calculate Your Income: Include salary, side hustles, investments, and bonuses.

- Track Your Expenses: Identify essential expenses (rent, groceries, insurance) and non-essential spending (entertainment, dining out).

- Follow the 50/30/20 Rule:

- 50% for needs (housing, bills, food)

- 30% for wants (entertainment, shopping, travel)

- 20% for savings and debt repayment

Tip: Use budgeting apps like YNAB, Mint, or PocketGuard to track your spending.

3. Avoid Lifestyle Inflation

As your income grows, it’s tempting to upgrade your lifestyle—buying a bigger house, driving a luxury car, or dining at expensive restaurants. This is called lifestyle inflation, and it can prevent you from building wealth.

How to Control Lifestyle Inflation

- Stick to your budget even after a salary increase.

- Increase your savings rate instead of unnecessary spending.

- Focus on long-term financial goals rather than materialistic upgrades.

Tip: Every time you get a raise, allocate a portion toward savings and investments before increasing expenses.

4. Build an Emergency Fund

Unexpected expenses like medical bills, car repairs, or job loss can derail your financial stability. An emergency fund acts as a financial cushion during tough times.

How Much Should You Save?

- Aim for 3-6 months’ worth of living expenses.

- Keep the funds in a high-yield savings account for easy access.

Tip: Set up automatic transfers to your emergency fund each month to build it consistently.

5. Manage Debt Wisely

Debt can be a major financial burden in your 30s. If left unchecked, high-interest debt (like credit cards) can prevent you from achieving financial freedom.

How to Reduce Debt Effectively

- Prioritize High-Interest Debt: Pay off credit cards and personal loans first.

- Use the Debt Snowball or Avalanche Method:

- Snowball Method: Pay off the smallest debts first for motivation.

- Avalanche Method: Pay off the highest-interest debts first to save money.

- Avoid Taking on Unnecessary Debt: Think twice before financing luxury purchases.

Tip: If you have multiple debts, consider debt consolidation to simplify payments and reduce interest rates.

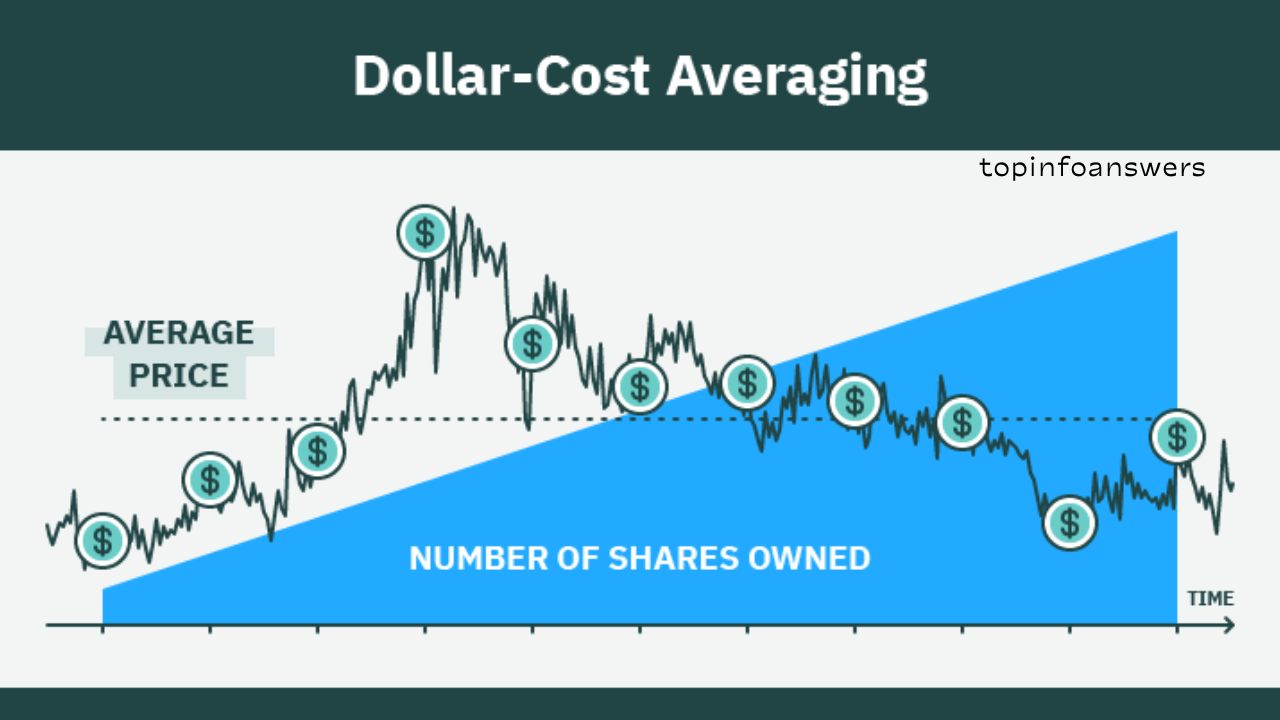

6. Start Investing Early

One of the biggest financial mistakes is not investing early enough. The sooner you start, the more time your money has to grow through compound interest.

Where to Invest?

- Stock Market: ETFs, index funds, and individual stocks.

- Real Estate: Buying property can be a good long-term investment.

- Retirement Accounts: 401(k), IRA, or other pension schemes.

Tip: Invest consistently, even if it’s a small amount, and let compound interest work in your favor.

7. Plan for Retirement Now

Many people ignore retirement planning in their 30s, thinking they have plenty of time. However, the earlier you start, the easier it will be to retire comfortably.

Steps to Secure Retirement

- Contribute to Your 401(k) or IRA: Take advantage of employer matches.

- Increase Contributions Over Time: As your income grows, increase your savings percentage.

- Diversify Retirement Investments: Don’t rely on just one source; spread your investments across different assets.

Tip: Use retirement calculators to estimate how much you’ll need and adjust your savings accordingly.

8. Have Adequate Insurance Coverage

Insurance protects you and your family from financial hardship due to unexpected events.

Essential Insurance Policies

- Health Insurance: Covers medical emergencies and hospital bills.

- Life Insurance: Provides financial security to your dependents.

- Disability Insurance: Protects your income in case of an injury.

- Home or Renters Insurance: Covers damages and liabilities.

Tip: Regularly review your insurance policies to ensure they align with your needs.

9. Improve Financial Literacy

Financial mistakes often happen due to a lack of knowledge. Educating yourself about money management can help you make informed decisions.

Ways to Improve Financial Literacy

- Read books like Rich Dad Poor Dad and The Millionaire Next Door.

- Follow personal finance blogs and podcasts.

- Take online courses on investing and money management.

Tip: Join financial communities or forums where you can discuss and learn from others.

10. Avoid Impulse Spending

Impulse purchases can drain your savings and push you into debt. Marketers use psychological tricks to make you spend more than necessary.

How to Control Impulse Spending

- Use the 30-day rule—wait 30 days before making non-essential purchases.

- Make a shopping list and stick to it.

- Unsubscribe from marketing emails and online store notifications.

Tip: Set a separate budget for fun expenses to avoid overspending impulsively.

11. Build Multiple Income Streams

Relying solely on a 9-to-5 job can be risky. Having multiple income sources can provide financial stability and growth opportunities.

How to Avoid Lifestyle Inflation and Keep Your Finances in Check

Ways to Create Additional Income

- Side Hustles: Freelancing, tutoring, consulting.

- Passive Income: Investing in stocks, rental properties, or royalties.

- Online Businesses: Selling digital products, affiliate marketing.

Tip: Use your skills and interests to explore new income opportunities.

12. Avoid Keeping Too Much Money in a Savings Account

While saving money is essential, keeping too much in a regular savings account can lead to low returns due to inflation.

Better Alternatives

- Invest excess savings in index funds or mutual funds.

- Keep only emergency funds in a high-yield savings account.

Tip: Make your money work for you by investing wisely.

13. Negotiate Your Salary

Many people accept job offers without negotiating, leaving money on the table.

How to Negotiate a Better Salary

- Research salary trends in your industry.

- Highlight your skills and accomplishments.

- Be prepared to walk away if the offer is too low.

Tip: Even a small salary increase can significantly impact your long-term earnings.

14. Avoid Co-Signing Loans

Co-signing a loan means you’re responsible if the other person fails to pay. This can ruin your credit and put you in financial trouble.

Better Alternatives

- Help the person find other financing options.

- Offer a small loan instead of co-signing.

Tip: Only co-sign if you’re 100% sure the borrower can repay.

15. Regularly Review Your Finances

Your financial situation changes over time, so it’s important to review and adjust your plans regularly.

What to Check?

- Budget and spending habits.

- Investment portfolio performance.

- Debt repayment progress.

Tip: Set a monthly financial check-in to stay on track.

Your 30s are a defining decade for financial success. By avoiding common mistakes and making smart decisions, you can set yourself up for long-term stability and wealth. Focus on budgeting, saving, investing, and increasing your income while avoiding unnecessary debt.

Start making these changes today, and your future self will thank you!