Financial growth doesn’t happen by chance—it’s the result of careful planning, smart investing, and disciplined money management. Whether you’re an individual looking to grow your personal wealth or a business owner striving for expansion, having a well-optimized financial strategy is essential. In this guide, we’ll cover key areas of financial planning, investment strategies, and wealth-building principles that will help you achieve maximum growth.

1. Understanding Your Financial Goals

Define Your Objectives

Before optimizing your financial strategy, you need to be clear about your goals. Ask yourself:

- Are you looking to build long-term wealth?

- Do you want financial independence or early retirement?

- Are you planning to start or expand a business?

- Do you need to save for a major purchase (home, car, education)?

Having well-defined short-term and long-term financial goals helps you create a roadmap for success.

SMART Financial Goals

Make sure your goals are:

- Specific: Clearly define what you want to achieve.

- Measurable: Track progress with numbers (e.g., save $50,000 in five years).

- Achievable: Set realistic goals based on your income and expenses.

- Relevant: Align your goals with your overall financial vision.

- Time-bound: Have a clear deadline for achieving your goals.

2. Building a Solid Financial Foundation

Create a Budget

A well-structured budget is the foundation of financial growth. Follow the 50/30/20 rule:

- 50% for Necessities (rent, utilities, groceries, transportation)

- 30% for Wants (entertainment, travel, shopping)

- 20% for Savings & Investments (retirement, emergency fund, stock market)

Use budgeting apps like YNAB (You Need A Budget), Mint, or PocketGuard to track your income and expenses.

Emergency Fund

Before focusing on investments, ensure you have an emergency fund covering 3–6 months of living expenses. This provides a safety net during financial crises and prevents debt accumulation.

Reduce High-Interest Debt

Debt with high interest (credit cards, personal loans) can drain your finances. Prioritize repaying them using either:

- Debt Snowball Method: Pay off smaller debts first for motivation.

- Debt Avalanche Method: Focus on high-interest debts first to save on interest.

3. Maximizing Income Streams

Increase Your Primary Income

If you’re employed, look for ways to boost your salary through:

- Career advancements (promotions, raises)

- Learning new high-income skills (coding, AI, data science, digital marketing)

- Negotiating salary based on market research

Side Hustles and Passive Income

Diversify your income through:

- Freelancing (writing, graphic design, consulting)

- Online Business (dropshipping, print-on-demand, digital products)

- Content Creation (YouTube, blogging, Instagram monetization)

- Affiliate Marketing (promoting products for commissions)

- Investing in Dividend Stocks (passive income from stock dividends)

- Real Estate Investing (rental income, house flipping)

4. Smart Investment Strategies

Stock Market Investments

Investing in stocks is one of the best ways to grow wealth over time. Strategies include:

- Index Funds & ETFs: Low-risk investments that track the overall market (e.g., S&P 500, Nasdaq ETFs).

- Dividend Stocks: Stocks that provide regular dividend income.

- Growth Stocks: Companies with high growth potential (e.g., AI, tech startups).

Real Estate Investments

Real estate provides both cash flow (rental income) and capital appreciation (property value increase). Options include:

- Rental Properties: Buy homes and rent them out.

- Real Estate Investment Trusts (REITs): Invest in real estate through stocks.

- House Flipping: Buy undervalued properties, renovate, and sell at a profit.

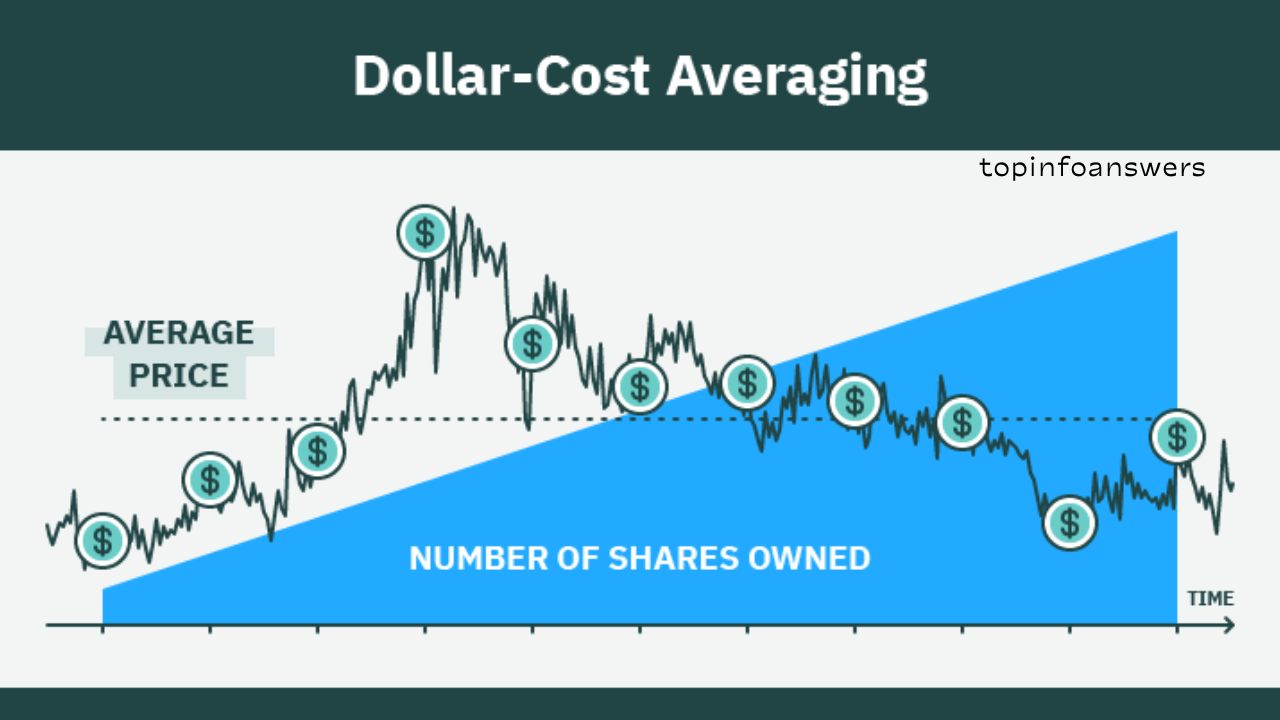

Cryptocurrency & Alternative Investments

While volatile, cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) have shown long-term growth potential. Consider:

- Dollar-Cost Averaging (DCA): Invest small amounts regularly to reduce risk.

- Stablecoins & Staking: Earn interest by holding crypto assets.

Other alternative investments include:

- Gold & Silver (hedge against inflation)

- Peer-to-Peer Lending (invest in loans for higher returns)

Retirement Planning

Invest in retirement accounts such as:

- 401(k) (U.S.): Employer-sponsored retirement plan with tax benefits.

- IRA (Individual Retirement Account): Offers tax-deferred or tax-free growth.

- NPS (India): National Pension System for long-term savings.

Start early to take advantage of compound interest, where your earnings generate additional earnings over time.

5. Tax Optimization Strategies

Maximize Tax Deductions

Claim deductions for:

- Business expenses (home office, travel, equipment)

- Charitable donations

- Education expenses

- Medical expenses

Utilize Tax-Advantaged Accounts

- Tax-free investment accounts (Roth IRA, TFSA)

- Employer-matching retirement contributions

- Capital Gains Tax Strategies (long-term holding for lower taxes)

Consult a tax professional to legally reduce your tax burden.

6. Optimizing Your Savings & Expenses

Automate Your Savings

Set up automatic transfers to your:

- Emergency fund

- Investment accounts

- Retirement savings

Cut Unnecessary Expenses

- Cancel unused subscriptions

- Reduce dining out and impulse purchases

- Use cashback and discount apps

7. Effective Wealth Protection Strategies

Insurance Coverage

Protect your financial future with:

- Health Insurance (avoid high medical bills)

- Life Insurance (financial security for your family)

- Disability Insurance (income protection in case of illness/injury)

- Home & Auto Insurance (protect your assets)

Estate Planning

Ensure your wealth is passed on efficiently by:

- Creating a Will (clear distribution of assets)

- Setting Up Trusts (tax benefits and controlled inheritance)

- Naming Beneficiaries (on financial accounts)

8. Leveraging Technology for Financial Growth

AI and Financial Tools

Use AI-powered financial tools for better money management:

- AI Budgeting Apps (like Cleo, Digit)

- AI Investment Platforms (like Wealthfront, Betterment)

- Stock Market Analysis Tools (like TradingView, AI-based stock screeners)

Stay Updated with Financial Trends

Follow financial news and experts through:

- News Websites (CNBC, Bloomberg, Forbes)

- Podcasts & YouTube Channels (Graham Stephan, Dave Ramsey, Warren Buffett insights)

9. Maintaining Financial Discipline

Review and Adjust Your Strategy Regularly

- Analyze your financial progress every 3–6 months.

- Adjust investments and savings based on market trends.

Develop a Wealth-Building Mindset

- Avoid emotional investing (stick to strategy).

- Delay gratification (invest instead of spending).

- Surround yourself with financially successful people.

10. The Power of Compounding

Why Start Early?

The earlier you invest, the more you benefit from compounding returns. Example:

- Investing $500/month at 8% annual return for 30 years = $745,000

- Investing the same for 10 years = $91,000

Time is your biggest asset—start NOW!

Optimizing your financial strategy requires a combination of budgeting, investing, tax planning, and wealth protection. By setting clear goals, diversifying income, making smart investments, and leveraging technology, you can achieve maximum financial growth. Stay disciplined, keep learning, and make informed financial decisions to secure a prosperous future.

Would you like help implementing these strategies step by step? Let me know how I can assist you!