Building wealth is a long-term process that requires discipline, patience, and a strategic approach to investing. While there are many ways to accumulate wealth, consistent investing stands out as one of the most reliable methods. Whether you’re a beginner or an experienced investor, applying a disciplined and consistent investing strategy can help you grow your financial portfolio and achieve long-term financial independence.

This blog post will explore how to build wealth through consistent investing, covering the principles, strategies, and best practices for sustainable financial growth.

Understanding the Power of Investing

Investing is the process of allocating money into financial instruments, such as stocks, bonds, mutual funds, real estate, or businesses, with the expectation of generating returns over time. Unlike saving, which primarily preserves capital, investing aims to grow your money by leveraging market opportunities.

The Power of Compound Interest

One of the key reasons why consistent investing is effective is due to the power of compound interest. Compound interest occurs when the returns on an investment generate additional earnings over time. This creates exponential growth in wealth, as returns are reinvested and compounded.

For example, if you invest $10,000 at an annual return rate of 8%, after 30 years, your investment will grow to approximately $100,626 without additional contributions. However, by consistently investing an additional $500 per month, your portfolio could grow to over $745,000.

Time in the Market vs. Timing the Market

Many investors try to time the market, buying assets when prices are low and selling when prices are high. However, predicting market movements accurately is extremely difficult, even for professionals. Instead of attempting to time the market, successful investors focus on staying invested for the long term. Historical data shows that markets tend to increase over time despite short-term volatility.

Strategies for Consistent Investing

1. Establish Clear Financial Goals

Before you start investing, it’s crucial to define your financial goals. These goals may include:

- Building a retirement fund

- Buying a house

- Funding a child’s education

- Creating passive income

Having specific, measurable, achievable, relevant, and time-bound (SMART) goals helps you stay focused and make informed investment decisions.

2. Develop a Budget and Allocate Funds for Investing

A well-structured budget ensures you can consistently allocate a portion of your income toward investments. Consider following the 50/30/20 rule:

- 50% of income for necessities (housing, food, bills)

- 30% for discretionary expenses (entertainment, travel)

- 20% for savings and investments

By consistently setting aside funds for investing, you build a habit that contributes to long-term wealth accumulation.

3. Choose the Right Investment Vehicles

Depending on your risk tolerance and financial goals, there are various investment options to consider:

a) Stocks

Investing in individual stocks allows you to own shares in companies with growth potential. Consider:

- Blue-chip stocks (established companies with a history of stable returns)

- Dividend stocks (companies that pay regular dividends)

- Growth stocks (companies with high growth potential)

b) Index Funds and ETFs

Index funds and Exchange-Traded Funds (ETFs) provide diversified exposure to the stock market with lower fees. They track major indices like the S&P 500, reducing the risk associated with individual stock selection.

c) Bonds

Bonds are fixed-income investments that provide steady returns with lower risk. Government and corporate bonds can be suitable for conservative investors looking for stability.

d) Real Estate

Investing in real estate, whether through rental properties or Real Estate Investment Trusts (REITs), can provide passive income and long-term appreciation.

e) Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio managed by professionals. They are ideal for those who prefer a hands-off approach.

f) Retirement Accounts (401(k), IRA, Roth IRA)

Tax-advantaged retirement accounts help grow wealth efficiently. Contributing to a 401(k) (especially if your employer offers a match) or an IRA maximizes long-term investment benefits.

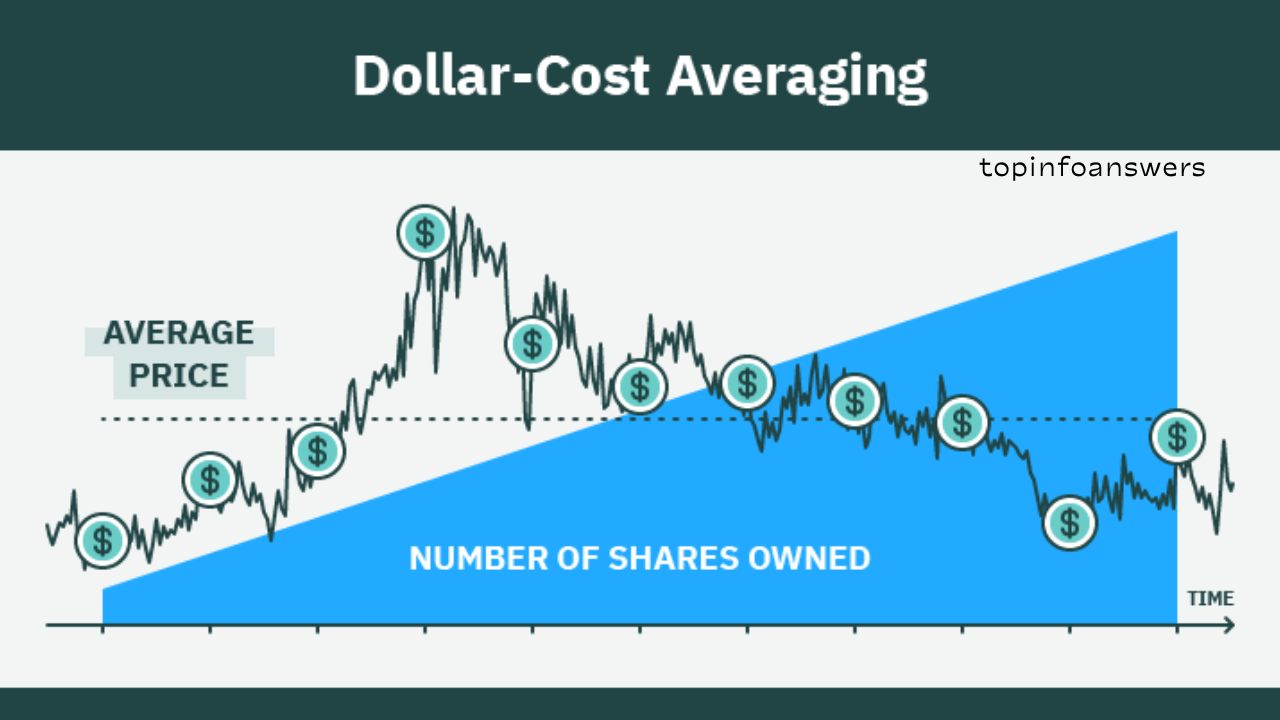

4. Adopt a Dollar-Cost Averaging Approach

Dollar-cost averaging (DCA) is a strategy where you invest a fixed amount of money at regular intervals, regardless of market conditions. This reduces the impact of market volatility and prevents emotional investing decisions.

For instance, investing $500 per month in an index fund ensures you buy more shares when prices are low and fewer when prices are high, ultimately lowering your average cost per share over time.

5. Diversify Your Portfolio

Diversification minimizes risk by spreading investments across different asset classes, industries, and geographies. A well-diversified portfolio may include:

- Domestic and international stocks

- Bonds and fixed-income securities

- Real estate or REITs

- Commodities like gold or silver

- Alternative investments (e.g., cryptocurrencies, hedge funds)

6. Reinvest Dividends and Interest

Reinvesting dividends and interest can significantly enhance portfolio growth. Instead of cashing out dividends, opt for reinvestment programs that automatically purchase additional shares, compounding your returns.

7. Maintain a Long-Term Perspective

Market fluctuations can be discouraging, but successful investors remain patient and stay the course. History shows that markets tend to recover from downturns and reward those who stick with their investments.

8. Avoid Emotional Investing

Fear and greed are the biggest enemies of investors. Making investment decisions based on emotions often leads to buying high and selling low. To avoid this, follow a disciplined investment plan and avoid reacting to short-term market movements.

9. Stay Informed and Continue Learning

Financial literacy is key to making informed investment decisions. Regularly educate yourself by reading books, attending seminars, following market trends, and seeking professional advice when necessary.

10. Periodically Review and Rebalance Your Portfolio

As life circumstances and market conditions change, your portfolio may need adjustments. Review your investments at least annually and rebalance if necessary to align with your goals and risk tolerance.

Overcoming Common Investment Challenges

Lack of Capital

If you have limited funds, start small. Many brokerage firms allow fractional investing, enabling you to invest in high-value stocks with as little as $5 or $10.

Market Volatility

Volatility is a normal part of investing. Maintain a long-term view, avoid panic selling, and use dollar-cost averaging to mitigate risk.

Inflation Risk

Inflation erodes purchasing power over time. To combat this, invest in assets that outpace inflation, such as stocks, real estate, and inflation-protected securities.

Lack of Knowledge

Leverage financial advisors, robo-advisors, and reputable investment platforms that offer educational resources to guide you in making sound investment decisions.

Building wealth through consistent investing is a journey that requires discipline, patience, and informed decision-making. By establishing clear goals, adopting a long-term mindset, and using effective strategies such as dollar-cost averaging and portfolio diversification, you can steadily grow your wealth over time.

Remember, the key to financial success lies not in trying to time the market but in staying committed to a disciplined investing plan. Start today, stay consistent, and watch your wealth grow!