In the pursuit of long-term financial success, optimizing your investment portfolio is essential. Your portfolio is essentially a collection of different assets—stocks, bonds, real estate, and other investments—that are designed to work together to help you reach your financial goals. A well-optimized portfolio allows you to balance risk and return in a way that best aligns with your objectives, time horizon, and risk tolerance. This article will explore the key strategies for optimizing your investment portfolio, including asset allocation, diversification, rebalancing, and adjusting your portfolio as your financial situation evolves.

1. Understanding the Basics of Portfolio Optimization

Portfolio optimization involves selecting the right mix of assets in your investment portfolio to achieve the desired balance between risk and reward. At its core, the goal of portfolio optimization is to maximize returns for a given level of risk, or alternatively, to minimize risk for a given level of expected return. The basic principles of portfolio optimization are centered on two key concepts:

-

Risk Tolerance: This refers to how much risk you are willing and able to take on in pursuit of higher returns. Risk tolerance can be influenced by factors such as your age, income, financial obligations, and personal preferences.

-

Time Horizon: The length of time you plan to keep your investments before needing to access the funds plays a crucial role in portfolio optimization. The longer your time horizon, the more risk you can typically afford to take since you have more time to recover from market fluctuations.

2. Asset Allocation: The Foundation of a Well-Optimized Portfolio

Asset allocation is one of the most important decisions you will make when optimizing your portfolio. It involves dividing your investments across different asset classes, such as stocks, bonds, real estate, and cash. The right allocation depends on your financial goals, risk tolerance, and time horizon.

-

Equities (Stocks): Stocks typically offer higher potential returns over the long term but come with a higher level of volatility. As a result, they are best suited for investors with a higher risk tolerance and a longer time horizon.

-

Fixed-Income Securities (Bonds): Bonds provide more stability than stocks and generate regular interest income. They are generally less risky, making them an essential part of a diversified portfolio, particularly for investors who want to reduce risk while maintaining growth potential.

-

Real Estate: Real estate investments can offer steady income through rents and potential for capital appreciation. It’s a more illiquid asset class but can be an important component of a diversified portfolio.

-

Commodities and Alternatives: Commodities such as gold, oil, and agricultural products can provide a hedge against inflation and act as a diversification tool. Alternative assets like hedge funds or private equity may also provide growth but with added complexity and risk.

How to Determine Your Ideal Asset Allocation

There is no one-size-fits-all approach to asset allocation. Several factors determine the optimal mix for your portfolio, including your investment goals, financial situation, and risk tolerance.

-

Conservative Allocation: If your priority is capital preservation and you have a low risk tolerance, you may want a larger portion of your portfolio allocated to bonds and cash, with a smaller portion in stocks and alternative assets.

-

Balanced Allocation: A balanced portfolio typically includes a mix of equities, bonds, and some exposure to alternative assets. This type of portfolio is appropriate for investors who want to capture long-term growth while maintaining a moderate level of risk.

-

Aggressive Allocation: If your goal is maximum growth and you are willing to accept higher levels of volatility, an aggressive portfolio will have a heavier allocation to equities, particularly growth stocks, with a smaller allocation to bonds or cash.

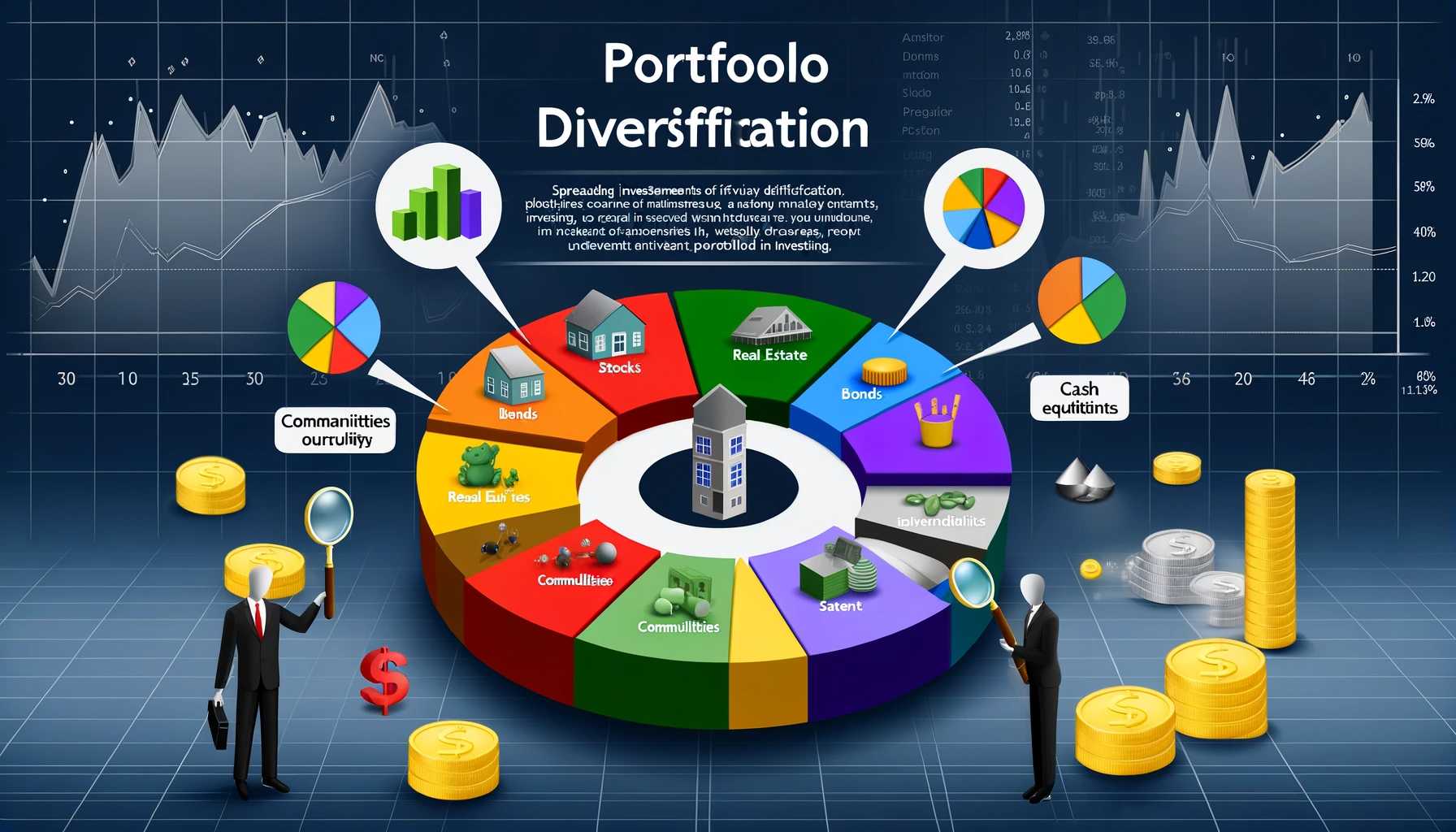

3. Diversification: Spreading Risk Across Multiple Assets

Diversification is the practice of spreading your investments across various asset classes, sectors, and geographic regions to reduce the risk of loss. By holding a diversified portfolio, the poor performance of one asset may be offset by the better performance of others.

-

Sector Diversification: Different sectors of the economy tend to perform well at different times. For instance, technology stocks may perform well during periods of innovation, while healthcare stocks may be more resilient during economic downturns. Diversifying across sectors helps mitigate the risks associated with relying too heavily on one sector.

-

Geographic Diversification: Investing in global markets allows you to benefit from growth in other countries and regions. It can also reduce the impact of economic or political disruptions in any one country.

-

Style Diversification: Within equities, it’s important to diversify between growth and value stocks, as well as between small-cap, mid-cap, and large-cap companies. Growth stocks may provide higher returns but come with higher volatility, while value stocks tend to be less volatile but offer lower growth potential.

4. Rebalancing Your Portfolio

Once you have established an asset allocation strategy, it’s essential to monitor and adjust it over time to maintain your desired balance. Rebalancing ensures that your portfolio does not become too heavily weighted in any one asset class due to changes in the market value of your investments.

-

Why Rebalance? Over time, some assets in your portfolio may perform better than others, causing your allocation to shift. For example, if the stock market performs well for a period, your equity holdings may become too large relative to your bond holdings. Rebalancing involves selling some of your overperforming assets and purchasing more of the underperforming ones to bring the portfolio back into alignment with your original allocation.

-

How Often Should You Rebalance? The frequency of rebalancing depends on your portfolio’s performance, your investment goals, and market conditions. Commonly, investors rebalance quarterly or annually. However, if there are significant changes in the market or your personal circumstances, you may need to adjust more frequently.

-

Costs of Rebalancing: Rebalancing can incur transaction costs, such as brokerage fees, taxes, and other expenses. It’s important to weigh these costs against the benefits of rebalancing to ensure that it remains advantageous in the long term.

5. Risk Management and Protecting Your Portfolio

An optimized portfolio isn’t just about maximizing returns—it’s also about managing risk to ensure you are not exposed to unnecessary losses. There are several strategies to help protect your portfolio:

-

Stop-Loss Orders: One method of managing risk is through stop-loss orders, which automatically sell an asset if its price drops to a certain level. This helps limit potential losses in a volatile market.

-

Hedging: Some investors use hedging techniques, such as buying put options or using inverse exchange-traded funds (ETFs), to protect their portfolios against market declines.

-

Asset Correlation: Understanding how different assets correlate with each other is crucial for risk management. For instance, stocks and bonds generally have a low correlation, meaning they often move in opposite directions. This makes them ideal for diversification. By combining assets that are not highly correlated, you can reduce the overall risk of your portfolio.

6. Adjusting Your Portfolio Over Time

As your financial situation and goals evolve, so too should your portfolio. Regularly reviewing your portfolio and making adjustments to reflect changes in your life, risk tolerance, and market conditions is essential for long-term financial success.

-

Life Events: Major life events, such as marriage, having children, or nearing retirement, often necessitate changes in your asset allocation. For example, as you approach retirement, you may want to reduce your exposure to equities and increase your allocation to safer, income-generating assets like bonds or dividend-paying stocks.

-

Changing Risk Tolerance: As you age or as your financial situation improves, your risk tolerance may change. For instance, if you are in your 20s and just starting to build your career, you might have a higher risk tolerance and invest more heavily in stocks. However, as you near retirement, you may want to shift to a more conservative allocation.

-

Market Conditions: While your long-term investment strategy should remain relatively stable, it’s also important to adjust your portfolio in response to significant market events. For instance, if a particular sector or asset class is underperforming, it may make sense to reduce your exposure to that area.

7. Tax-Efficient Investing

Tax efficiency is a crucial element of portfolio optimization, as taxes can erode your returns over time. To minimize the impact of taxes on your portfolio:

-

Tax-Deferred Accounts: Utilize tax-advantaged accounts like IRAs and 401(k)s, where your investments can grow tax-deferred or even tax-free, depending on the type of account.

-

Tax-Loss Harvesting: This strategy involves selling investments that have declined in value to offset taxable gains from other investments. This can help reduce your tax liability in a given year.

-

Capital Gains Management: Holding investments for longer than one year allows you to take advantage of lower long-term capital gains tax rates. Be mindful of when you sell your investments to minimize the tax impact.

Optimizing your investment portfolio for long-term financial success requires careful planning, diversification, and ongoing management. By selecting the right asset allocation, managing risk, rebalancing regularly, and adjusting your portfolio as your life and financial situation change, you can set yourself up for financial success. While it takes time and effort to build and maintain an optimized portfolio, the rewards—greater financial security and the ability to achieve your financial goals—are well worth it.

As you embark on this journey, remember that the key to long-term success is not chasing short-term gains but focusing on steady, sustainable growth. With patience, discipline, and a well-optimized portfolio, you can achieve your financial objectives and secure a comfortable financial future.