Equity crowdfunding has revolutionized the investment landscape, enabling individuals to invest in startups and private companies in exchange for ownership shares. Unlike traditional investing, where venture capitalists and angel investors dominated, equity crowdfunding allows everyday investors to participate in early-stage funding rounds. This article provides a comprehensive guide on how to invest in equity crowdfunding, covering the benefits, risks, platforms, and best practices.

What is Equity Crowdfunding?

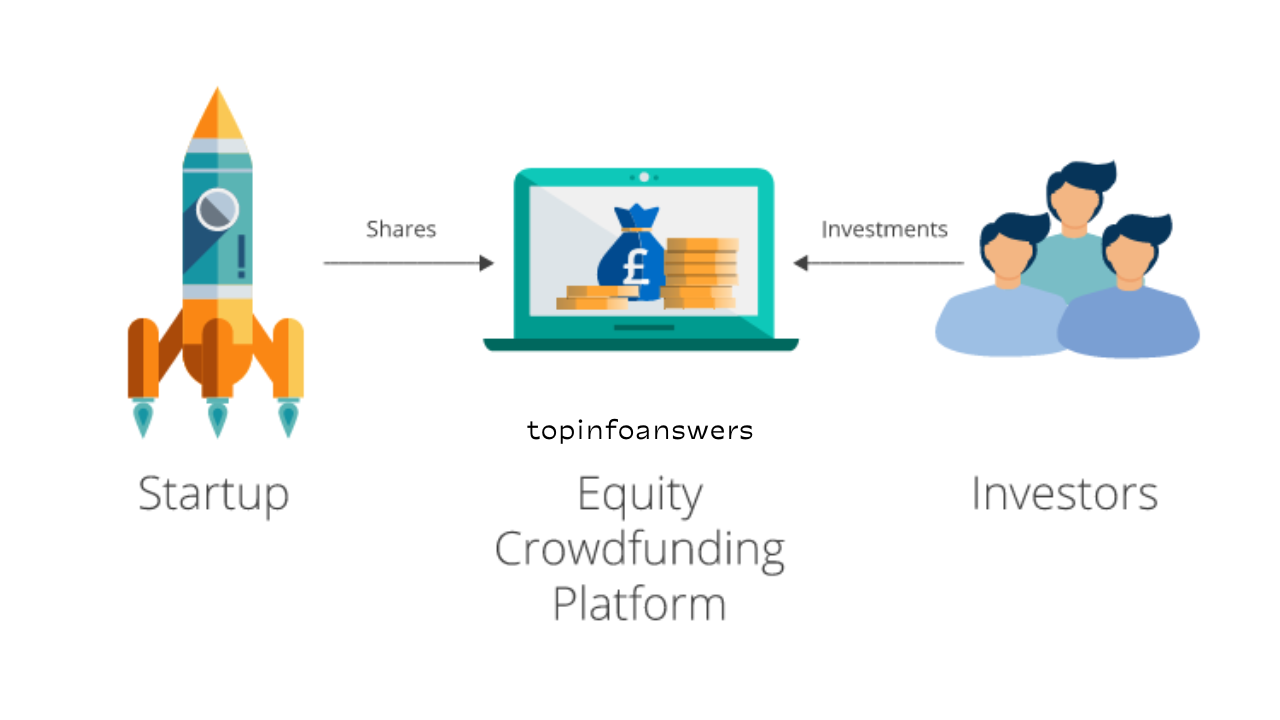

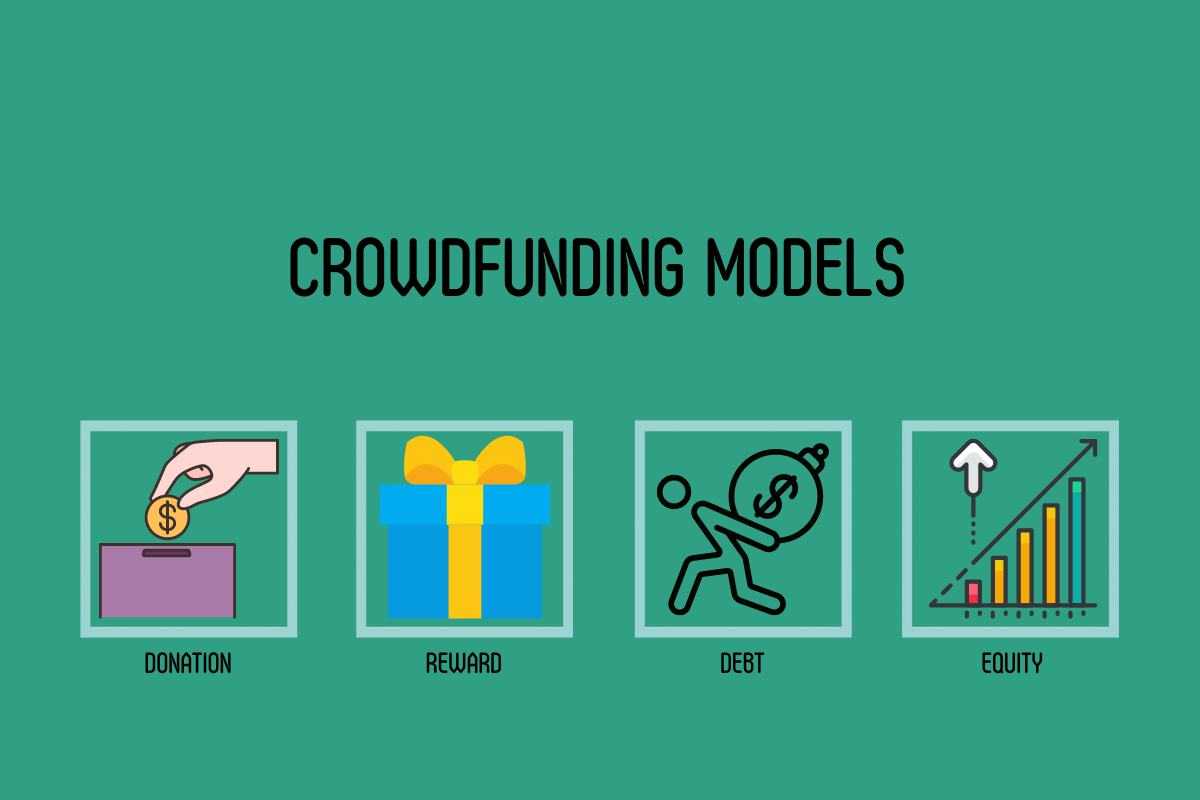

Equity crowdfunding is a method of raising capital where startups and private businesses sell shares to a large number of investors via online platforms. Unlike reward-based crowdfunding (e.g., Kickstarter), where backers receive products or perks, equity crowdfunding investors gain partial ownership in the company. The success of the investment depends on the company’s growth and potential exit strategies such as acquisitions or IPOs.

Benefits of Equity Crowdfunding

1. Access to Early-Stage Investments

Equity crowdfunding provides opportunities to invest in startups at an early stage, potentially leading to high returns if the business succeeds.

2. Portfolio Diversification

Investing in startups diversifies an investment portfolio beyond stocks, bonds, and real estate.

3. Supporting Innovation and Entrepreneurship

Investors help innovative businesses grow, contributing to economic development and job creation.

4. Low Investment Minimums

Many platforms allow investments with as little as $100, making it accessible to a wider range of investors.

Risks of Equity Crowdfunding

1. High Failure Rates

Startups are inherently risky, and many fail before becoming profitable, leading to a total loss of investment.

2. Lack of Liquidity

Unlike publicly traded stocks, equity crowdfunding investments are illiquid, meaning investors may have to wait years for an exit opportunity.

3. Limited Information

Private companies are not required to disclose as much financial information as publicly traded companies, making due diligence challenging.

4. Potential Dilution

As startups raise additional funding rounds, early investors may see their ownership percentage decrease.

How to Start Investing in Equity Crowdfunding

1. Choose the Right Crowdfunding Platform

There are several crowdfunding platforms that cater to different types of investors and industries. Some of the most popular equity crowdfunding platforms include:

- Republic – Offers investments in startups, real estate, and crypto projects.

- SeedInvest – Provides access to high-quality, vetted startups.

- WeFunder – One of the largest platforms with a diverse range of startups.

- StartEngine – Allows investors to buy shares in startups and even the platform itself.

- Crowdcube – A UK-based platform for European investors.

2. Research Potential Investments

Before investing, conduct thorough research on the company, including:

- Business model and market opportunity

- Revenue and financial projections

- Founder’s background and team experience

- Competitive landscape

- Risks and challenges

3. Assess the Valuation and Equity Offer

Startups list their valuations and the percentage of equity they are offering. Ensure the valuation is reasonable compared to industry standards and the company’s growth potential.

4. Diversify Your Investments

Since startup investing is high-risk, spread your investments across multiple companies to mitigate losses.

5. Understand the Terms of Investment

Each investment opportunity will have unique terms, including:

- Voting rights – Some shares may not grant voting power.

- Exit strategies – Possible scenarios for receiving returns (e.g., IPO, acquisition).

- Revenue-sharing agreements – Some companies offer revenue-based returns.

6. Monitor Your Investments

After investing, stay updated on company progress through investor updates provided by the crowdfunding platform.

Strategies for Success in Equity Crowdfunding

1. Invest in Industries You Understand

Having industry knowledge helps in assessing a startup’s potential and risks more accurately.

2. Look for Experienced Founders

Startups led by experienced entrepreneurs with a track record of success have higher chances of growth and success.

3. Prioritize Companies with Clear Growth Plans

A well-defined roadmap for expansion and revenue generation increases the likelihood of a positive return on investment.

4. Pay Attention to Market Trends

Invest in startups that align with growing industry trends, such as fintech, health tech, and renewable energy.

5. Avoid Emotional Investing

Invest based on data and analysis rather than excitement about a particular product or idea.

Tax Implications of Equity Crowdfunding Investments

Investing in equity crowdfunding can have tax implications, such as:

- Capital gains tax – If the investment appreciates and is sold, investors may owe capital gains tax.

- Loss deductions – Some jurisdictions allow deductions for losses incurred from startup investments.

- Tax-advantaged accounts – In some cases, investments can be made through retirement accounts like a Self-Directed IRA.

Equity crowdfunding is an exciting way to invest in early-stage companies, support innovation, and potentially earn high returns. However, it carries significant risks, including high failure rates and lack of liquidity. By choosing the right platforms, conducting thorough research, and diversifying investments, investors can improve their chances of success. As with any investment, it is crucial to invest only what you can afford to lose and to stay informed about market trends and regulations.