Changing careers can be an exciting yet daunting experience. Whether you’re switching industries, starting your own business, or taking a temporary break, financial stability is crucial to navigating this transition successfully. Managing your finances during a career change requires careful planning, budgeting, and strategic decision-making. In this guide, we’ll explore practical steps to help you maintain financial security while making your next career move.

1. Assess Your Financial Situation

Before making any career transition, take stock of your current financial standing. This includes:

- Income and Expenses: Review your monthly earnings and spending habits to understand where your money is going.

- Savings and Emergency Fund: Determine how much you have saved and whether it can cover at least three to six months of expenses.

- Debts and Obligations: List your outstanding debts, including credit cards, loans, and mortgage payments, to factor them into your financial plan.

- Retirement and Investments: Check your retirement accounts and other investments to ensure they remain on track despite your career change.

By analyzing your financial health, you can develop a strategy that minimizes financial strain during your transition.

2. Create a Career Transition Budget

A career change often involves a period of reduced or uncertain income. Creating a transition budget helps you control expenses and maintain financial stability. Consider the following:

- Prioritize Essential Expenses: Focus on necessities like rent/mortgage, utilities, groceries, and insurance.

- Cut Unnecessary Costs: Reduce discretionary spending on dining out, subscriptions, and entertainment.

- Find Cost-Effective Alternatives: Look for budget-friendly options, such as cooking at home or using public transportation.

- Plan for One-Time Costs: Account for expenses related to job searching, certifications, or moving costs if relocation is necessary.

A well-structured budget ensures you make informed financial decisions and avoid unnecessary debt.

3. Build or Strengthen Your Emergency Fund

An emergency fund is a financial safety net that provides security during career transitions. If you don’t already have one, start building it as soon as possible. Ideally, your emergency fund should cover three to six months’ worth of essential expenses.

Ways to Build Your Emergency Fund:

- Redirect a portion of your current salary to a high-yield savings account.

- Cut non-essential expenses and allocate savings toward your fund.

- Take on temporary freelance or gig work to boost savings before leaving your current job.

Having an emergency fund prevents financial stress and allows you to focus on your career goals.

4. Manage Debt Wisely

Carrying debt during a career transition can be risky, especially if you have limited income. Develop a strategy to manage your debts effectively:

- Prioritize High-Interest Debt: Pay off credit cards and high-interest loans first to reduce financial burden.

- Negotiate Payment Plans: Contact lenders to discuss flexible payment options if needed.

- Avoid New Debt: Limit the use of credit cards and avoid unnecessary loans until your income stabilizes.

- Consolidate or Refinance Loans: Consider refinancing options to lower interest rates and reduce monthly payments.

A proactive approach to debt management ensures you stay financially secure throughout your career change.

5. Explore Alternative Income Sources

During a career change, exploring additional income streams can provide financial relief. Consider:

- Freelancing or Consulting: Use your existing skills to earn money on platforms like Upwork or Fiverr.

- Part-Time or Gig Work: Consider temporary jobs, such as ride-sharing, tutoring, or pet sitting.

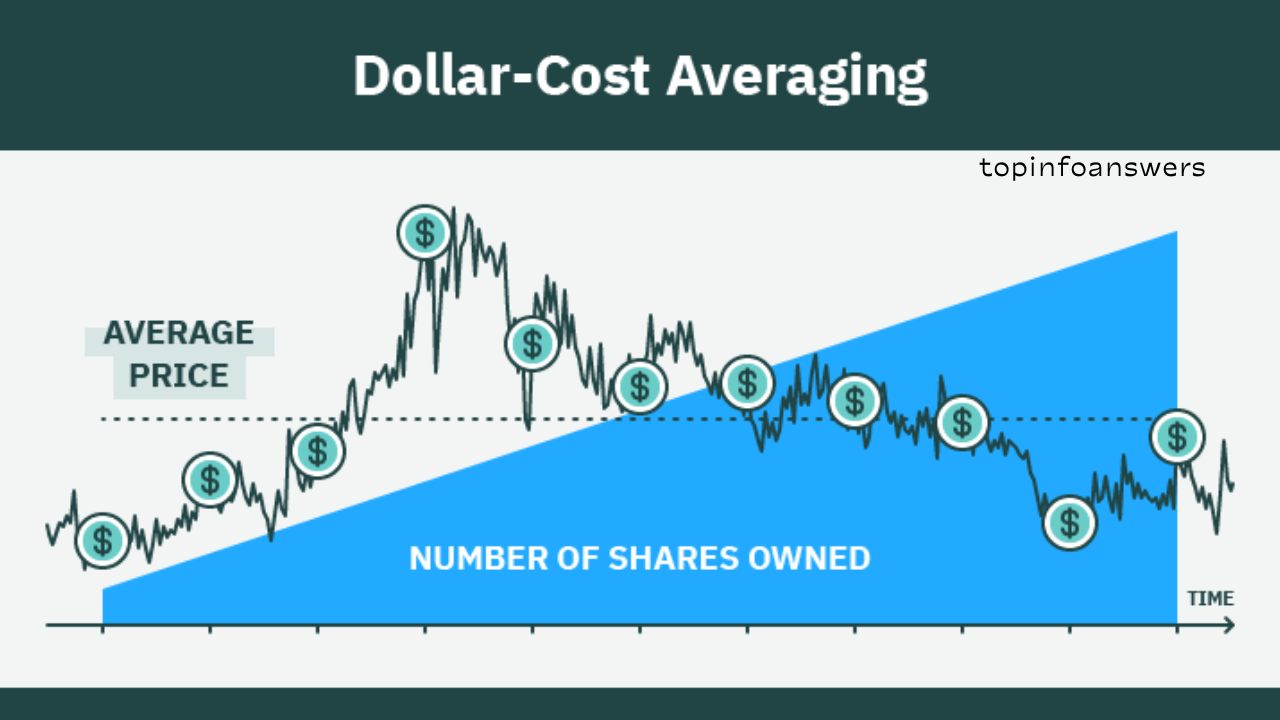

- Passive Income: Monetize hobbies, such as blogging, investing, or renting out property.

- Selling Unused Items: Declutter your home and sell items online for extra cash.

Supplementing your income reduces financial pressure and provides more flexibility during your transition.

6. Maintain Health Insurance Coverage

Losing employer-provided health insurance can be a major concern when changing careers. To avoid unexpected medical expenses, consider the following options:

- COBRA Coverage: If available, you can temporarily continue your previous employer’s insurance.

- Marketplace Plans: Explore healthcare plans through the Affordable Care Act (ACA) marketplace.

- Spousal or Family Plans: If your spouse has employer-sponsored insurance, check if you can join their plan.

- Short-Term Health Plans: Consider temporary insurance options if your transition period is brief.

Ensuring continuous health coverage protects you from high medical costs and unexpected emergencies.

7. Manage Retirement and Investment Accounts

A career change should not derail your long-term financial goals, including retirement savings. Be mindful of your retirement plans:

- 401(k) or 403(b) Rollovers: If you had a retirement account with your previous employer, consider rolling it into an IRA or your new employer’s plan.

- Avoid Early Withdrawals: Withdrawing funds early can result in penalties and tax implications.

- Continue Contributions: If possible, keep contributing to your retirement accounts, even at a reduced rate.

- Assess Investment Strategies: Review your investment portfolio and adjust it if needed based on your new financial situation.

Maintaining a focus on long-term financial security ensures your career change doesn’t hinder your future wealth.

8. Take Advantage of Career Change Financial Assistance

There are financial resources and programs designed to support individuals undergoing career transitions. Explore the following options:

- Unemployment Benefits: If eligible, apply for unemployment benefits to receive temporary financial support.

- Scholarships and Grants: Look for educational funding opportunities if your career change requires new certifications or degrees.

- Workforce Development Programs: Many local and federal programs offer job training and career counseling.

- Employer Severance Packages: If you are leaving a job voluntarily or involuntarily, check if your employer offers severance pay.

Utilizing available resources can help ease the financial burden of a career transition.

9. Plan for Taxes

A career change can impact your tax situation, especially if your income fluctuates. Take the following tax-related steps:

- Understand Tax Implications: If you become self-employed or start freelancing, learn about estimated tax payments.

- Keep Track of Expenses: Maintain records of job-related expenses, as some may be tax-deductible.

- Consult a Tax Professional: Seek guidance from an accountant to ensure compliance with tax laws.

- Adjust Tax Withholding: If your income decreases, updating your tax withholding can prevent overpaying taxes.

Proper tax planning prevents surprises and keeps your finances on track during your career change.

10. Set Realistic Career and Financial Goals

Finally, establishing clear financial and career goals ensures you stay focused during your transition. Consider:

- Short-Term Goals: Create a timeline for job applications, networking, and skill development.

- Mid-Term Goals: Plan financial milestones, such as debt reduction or reaching a savings target.

- Long-Term Goals: Align your career aspirations with financial stability and retirement planning.

Having a roadmap keeps you motivated and financially prepared for the future.

Managing your finances during a career change requires careful planning, budgeting, and smart decision-making. By assessing your financial situation, creating a transition budget, building an emergency fund, and exploring alternative income sources, you can navigate this transition smoothly. Additionally, ensuring health insurance coverage, managing retirement accounts, utilizing financial assistance, and planning for taxes will further secure your financial stability.

A career change is an opportunity for growth and new beginnings. With the right financial strategies in place, you can confidently take the next step in your professional journey while maintaining financial security.