Investing in the stock market can be daunting, especially for beginners who fear the volatility and potential risks associated with buying assets at the wrong time. One strategy that can help mitigate these risks and create a disciplined investment approach is Dollar-Cost Averaging (DCA). This method involves investing a fixed amount of money at regular intervals, regardless of market conditions.

In this article, we will explore what dollar-cost averaging is, how it works, its benefits, potential drawbacks, and why it is an effective investment strategy for both beginners and experienced investors.

What Is Dollar-Cost Averaging?

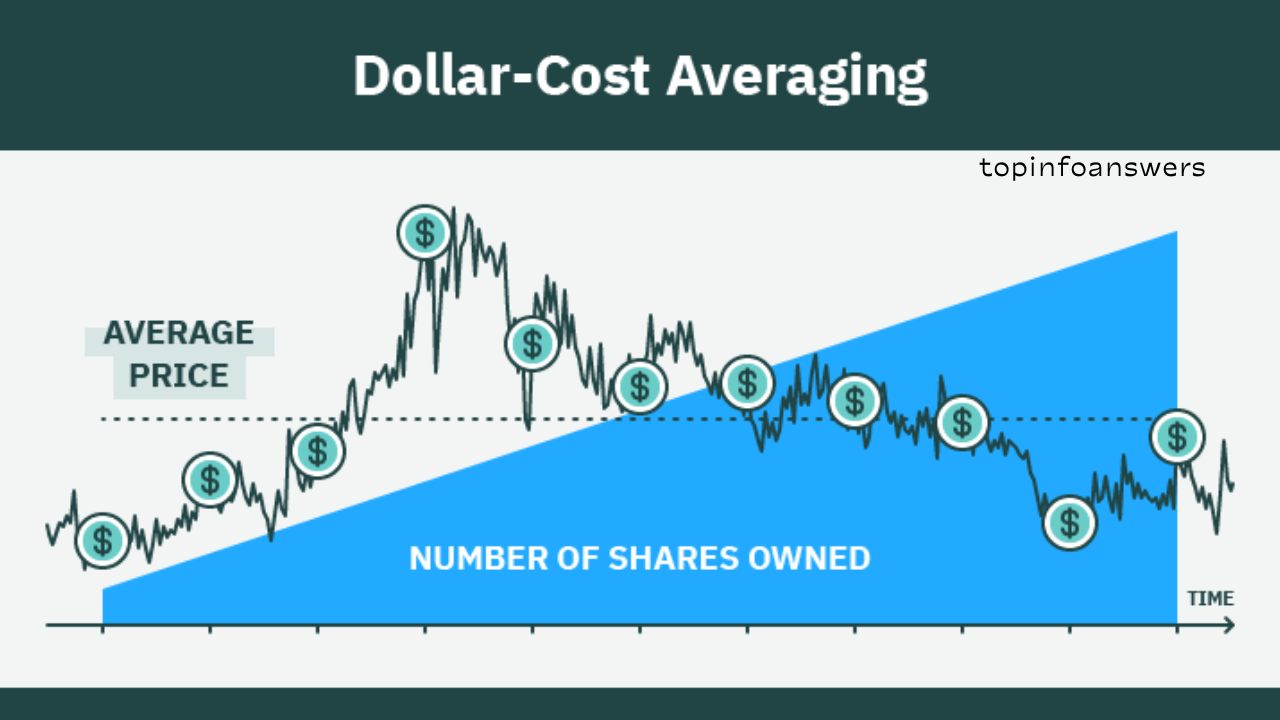

Dollar-cost averaging (DCA) is an investment strategy in which an investor divides a total sum of money into equal amounts and invests these amounts at regular intervals over a specific period. This method is designed to reduce the impact of market volatility by spreading out purchases over time rather than making a lump-sum investment all at once.

Example of Dollar-Cost Averaging

Imagine an investor wants to invest $12,000 in a stock or exchange-traded fund (ETF). Instead of investing the entire amount at once, they decide to invest $1,000 per month for 12 months. If the price of the asset fluctuates over that time, the investor buys more shares when prices are low and fewer shares when prices are high. This helps to average out the cost per share over time.

How Does Dollar-Cost Averaging Work?

Step 1: Choose an Investment

Select a stock, ETF, mutual fund, or cryptocurrency that aligns with your long-term financial goals.

Step 2: Determine the Investment Amount

Decide how much you want to invest at each interval. This could be a set amount per month, week, or quarter.

Step 3: Invest Regularly

Commit to investing the fixed amount regardless of market fluctuations. Automated investment plans offered by brokerages can help ensure consistency.

Step 4: Hold for the Long Term

DCA is most effective for long-term investors. Over time, markets tend to trend upward, allowing investors to benefit from compound growth.

Benefits of Dollar-Cost Averaging

1. Reduces Market Timing Risk

Trying to predict the best time to enter the market is challenging, even for experienced investors. DCA eliminates the need for market timing by ensuring investments are spread out over time.

2. Mitigates Volatility Impact

Markets fluctuate daily, but with DCA, an investor buys more shares when prices are low and fewer shares when prices are high. This smooths out the effects of volatility and reduces the risk of investing a lump sum at a market peak.

3. Encourages Discipline and Consistency

Investors may be tempted to make emotional decisions based on market trends. DCA enforces a disciplined, long-term strategy that removes emotional bias from investment decisions.

4. Ideal for Long-Term Wealth Building

By consistently investing, individuals can benefit from compound interest, where earnings generate additional earnings over time, leading to substantial long-term wealth accumulation.

5. Affordable for Small Investors

DCA allows individuals with limited capital to start investing with small, manageable amounts rather than requiring a large upfront investment.

6. Reduces Psychological Stress

Investing a lump sum during a market downturn can be stressful. DCA reduces anxiety because investors don’t have to worry about entering the market at the perfect time.

Potential Drawbacks of Dollar-Cost Averaging

1. May Underperform Lump-Sum Investing

Research suggests that, historically, investing a lump sum in a rising market yields higher returns than DCA. This is because markets generally trend upwards over the long term, meaning the sooner money is invested, the greater its growth potential.

2. Transaction Fees

If an investor is paying commissions or fees per transaction, frequent purchases can increase costs. However, many brokerages now offer commission-free trading, mitigating this concern.

3. Not Effective in a Constantly Rising Market

If the market is consistently increasing, DCA results in buying at progressively higher prices. In such cases, a lump-sum investment may have been a better choice.

Who Should Use Dollar-Cost Averaging?

1. Beginner Investors

DCA is ideal for new investors who want to start investing but are unsure about market timing.

2. Long-Term Investors

Individuals saving for retirement or long-term goals (e.g., college funds, home purchases) can benefit from the disciplined approach of DCA.

How to Use Tax-Loss Harvesting to Improve Your Investment Returns

3. Investors Concerned About Market Volatility

Those who want to minimize the risks associated with market fluctuations can use DCA to spread their investments over time.

4. Employees Contributing to Retirement Accounts

Employer-sponsored retirement plans like 401(k)s and IRAs use DCA because employees contribute a fixed amount regularly, allowing them to benefit from market fluctuations over time.

Dollar-Cost Averaging vs. Lump-Sum Investing

| Feature | Dollar-Cost Averaging (DCA) | Lump-Sum Investing |

|---|---|---|

| Market Timing Risk | Reduced | Higher |

| Volatility Impact | Lessened | Greater exposure to short-term fluctuations |

| Potential Returns | Generally lower in rising markets | Higher if invested in a growing market |

| Emotional Investing | Lower emotional impact | Can be emotionally stressful |

| Best For | Risk-averse, long-term investors | Investors confident in long-term growth |

Real-World Example of Dollar-Cost Averaging

Case Study: Investing in the S&P 500

Suppose an investor started contributing $500 per month to an S&P 500 index fund in January 2010. Over the next decade, the market experienced fluctuations, including the 2020 COVID-19 crash. However, by continuously investing, the investor accumulated shares at different price points and benefited from the market’s overall growth.

If the same investor had tried to time the market and missed key recovery periods, they might have underperformed compared to the steady DCA strategy.

How to Implement Dollar-Cost Averaging in Your Investment Portfolio

- Choose an Investment Account – Open a brokerage account with platforms like Vanguard, Fidelity, Schwab, or Robinhood.

- Select Your Investments – Opt for diversified assets such as ETFs, index funds, or stocks.

- Set an Investment Schedule – Automate contributions (e.g., weekly, bi-weekly, or monthly).

- Stick to the Plan – Continue investing regardless of market conditions.

- Review Periodically – Assess portfolio performance but avoid making impulsive decisions based on short-term movements.

Dollar-cost averaging is a powerful strategy for long-term investors who want to reduce risk, stay disciplined, and build wealth steadily over time. While it may not always maximize returns compared to lump-sum investing in a rising market, it offers stability, minimizes emotional decision-making, and provides a practical way for individuals to invest without worrying about market fluctuations.

How to Save for Your Dream Vacation Without Breaking the Bank

For most investors—especially beginners or those contributing to retirement accounts—DCA remains an effective and stress-free approach to achieving financial goals. By consistently investing a fixed amount at regular intervals, anyone can develop strong investment habits and benefit from long-term market growth.