Saving for major purchases such as a car, home, or even a dream vacation requires planning, discipline, and financial literacy. While these purchases significantly impact your lifestyle, they also come with hefty price tags that demand strategic saving and budgeting. Without a clear savings plan, you may find yourself relying on high-interest loans or credit cards, which can hinder your financial stability.

In this article, we will explore the best ways to save for major purchases, offering practical strategies and expert tips to help you achieve your financial goals without unnecessary debt.

Understanding the Importance of Saving for Major Purchases

Major purchases represent significant financial milestones that often require a considerable upfront payment. Saving for them is essential for several reasons:

- Financial Stability: Having enough savings reduces the need for loans, lowering your debt burden.

- Avoiding Interest Costs: Paying in cash or with a substantial down payment reduces or eliminates interest payments.

- Better Bargaining Power: With sufficient savings, you may have more negotiating leverage when purchasing a car or home.

- Reduced Financial Stress: Being prepared with savings ensures you won’t deplete emergency funds or other financial resources.

Setting Clear Financial Goals

Before you start saving, it’s essential to define your financial goals clearly. This involves identifying the purchase, estimating the costs, and setting a realistic timeline.

1. Specify the Major Purchase

Clarify what you’re saving for. Is it a car, a house, or a luxurious vacation? Understanding the purchase type helps you determine the required savings amount and the time horizon.

2. Establish a Timeline

Determine how long you have to save for the purchase. For example:

- Car Purchase: 1-3 years

- Home Down Payment: 3-10 years

- Vacation: 6 months – 2 years

3. Set a Savings Target

Calculate the total amount you need, factoring in taxes, fees, and additional expenses (e.g., maintenance or closing costs).

✅ Example:

If you’re saving for a car that costs ₹15,00,000 in India, consider adding an extra 10-15% for taxes and registration fees. Your total savings goal might be ₹16,50,000.

Creating a Dedicated Savings Plan

Once you’ve defined your goals, it’s time to develop a savings plan.

1. Prioritizing Major Purchases

If you’re saving for multiple goals, prioritize them based on urgency and importance. For example:

- High Priority: Home purchase

- Medium Priority: Car purchase

- Low Priority: Luxury vacation

2. Estimating the Costs

Research the current market rates for your desired purchase. Include additional expenses like insurance, maintenance, or closing costs.

3. Choose the Right Saving Vehicles

For short-term goals (less than three years), opt for low-risk saving vehicles, while long-term goals can benefit from a mix of savings and investments.

Effective Saving Strategies

1. Automate Your Savings

Automating your savings ensures consistency. Set up automatic transfers from your main account to a dedicated savings account. This prevents the temptation to spend the money.

2. Open a High-Yield Savings Account

For large purchases, consider parking your money in a high-yield savings account. These accounts offer better interest rates than regular savings accounts, helping your money grow faster.

3. Leverage Certificate of Deposits (CDs)

If you have a long-term saving horizon, CDs offer guaranteed returns with fixed interest rates. However, they have limited liquidity, making them ideal for disciplined saving.

4. Use Money Market Accounts

Money market accounts provide higher interest rates than standard savings accounts, making them suitable for medium-term goals.

Budgeting and Cutting Expenses

One of the most effective ways to boost your savings is by trimming unnecessary expenses.

1. Track Your Spending

Use budgeting apps like YNAB, Mint, or PocketGuard to monitor your spending patterns. Identify areas where you can cut back.

2. Reduce Unnecessary Expenses

Cutting back on dining out, subscription services, and impulse purchases can significantly increase your savings rate.

✅ Example:

Skipping a ₹300 coffee three times a week saves you approximately ₹3,600 per month, which adds up to ₹43,200 annually.

3. Adopt Frugal Living Habits

Consider adopting frugal habits like:

- Meal prepping instead of eating out

- Canceling unused subscriptions

- Using public transport instead of ride-sharing services

Investing to Grow Your Savings

Investing can accelerate your savings, especially for long-term goals.

1. Stocks and Mutual Funds

For long-term purchases (e.g., a home), consider investing in a diversified portfolio of stocks or mutual funds. Historically, these assets offer higher returns but come with market risks.

2. Bonds and Treasury Securities

Bonds offer stability and lower risk. They are ideal for medium-term goals, as they provide fixed income returns.

3. Real Estate Investment Trusts (REITs)

If you’re saving for a home, investing in REITs can offer real estate exposure and dividends, which can supplement your savings.

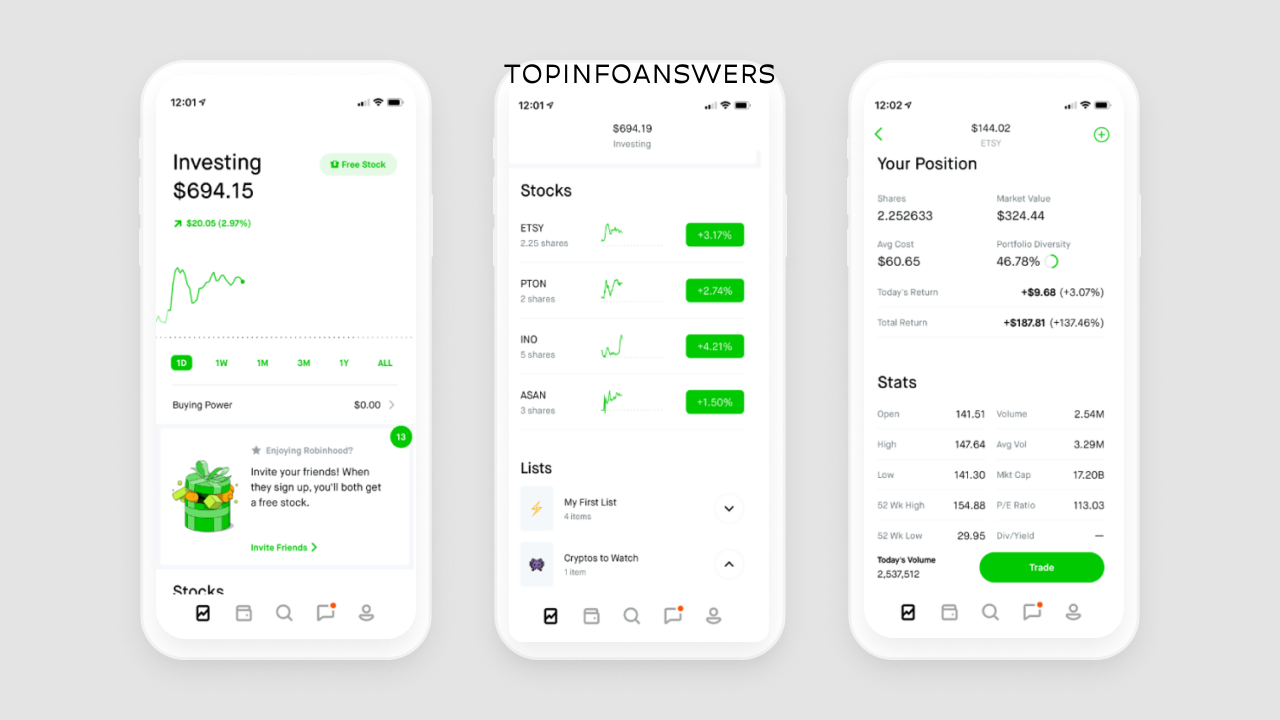

Leveraging Financial Tools and Apps

Financial apps can help you automate, track, and optimize your savings.

- Acorns: Rounds up your purchases and invests the spare change.

- Digit: Analyzes your spending habits and automatically transfers small amounts to your savings.

- YNAB (You Need A Budget): Helps you allocate every dollar toward specific goals.

Utilizing Windfalls and Bonuses

Use unexpected income to accelerate your savings.

- Tax Refunds: Direct tax refunds toward your major purchase fund.

- Work Bonuses: Allocate work bonuses or performance incentives to your savings.

- Gifts or Inheritance: Instead of spending windfalls, use them to strengthen your savings plan.

Smart Borrowing and Financing Options

If you’re unable to save the entire amount, consider smart borrowing options with favorable terms.

1. Low-Interest Loans

For cars or homes, opt for loans with low-interest rates. A larger down payment reduces the loan amount, making it easier to repay.

2. Leverage Employer Assistance

Some employers offer assistance programs for home purchases or vehicle financing. Take advantage of these if available.

3. Compare Loan Offers

Shop around for the best interest rates and loan terms before committing to a financing option.

Avoiding Common Saving Mistakes

Many people struggle with saving due to common financial mistakes.

- Not Accounting for Inflation: Failing to consider inflation reduces the purchasing power of your savings.

- Frequent Withdrawals: Withdrawing from your savings fund disrupts your progress.

- Relying Too Much on Credit: Accumulating debt through credit cards or loans increases the total cost of the purchase due to interest payments.

Saving for major purchases such as a car or home requires planning, discipline, and smart financial strategies. By setting clear financial goals, creating a dedicated savings plan, and using effective strategies like automating your savings, cutting expenses, and leveraging financial tools, you can reach your savings target faster.

Incorporating investing and making smart financing decisions ensures you not only save efficiently but also grow your wealth in the process. With careful planning, you can make significant purchases without sacrificing your financial stability.