Planning your financial goals for the next five years is crucial for achieving financial stability, security, and growth. Whether you aim to buy a home, save for retirement, pay off debt, or start a business, setting clear, actionable financial goals can help you stay on track. This guide will walk you through the steps to effectively plan your finances for the next five years, ensuring you make informed decisions and reach your aspirations.

Step 1: Assess Your Current Financial Situation

Before setting new financial goals, it’s essential to analyze where you currently stand. This includes:

1. Calculating Your Net Worth

Your net worth is the difference between what you own (assets) and what you owe (liabilities). To determine your net worth:

- List your assets (savings, investments, real estate, retirement accounts, etc.)

- List your liabilities (debts, loans, mortgages, credit card balances, etc.)

- Subtract liabilities from assets

2. Reviewing Your Income and Expenses

Track your monthly income and expenses to understand your spending habits. Categorize your expenses into essentials (rent, utilities, groceries) and non-essentials (entertainment, dining out, subscriptions). Identify areas where you can cut back.

3. Checking Your Credit Score

A good credit score can help you secure better loan terms and interest rates. Obtain a free credit report and ensure there are no errors. If your score is low, work on improving it by paying bills on time and reducing debt.

Step 2: Define Your Financial Goals

Setting specific financial goals will help you stay motivated and track progress. Your goals should be:

- Specific (e.g., Save $20,000 for a house down payment)

- Measurable (Track progress regularly)

- Achievable (Set realistic targets)

- Relevant (Align with your financial needs and lifestyle)

- Time-bound (Set a deadline for achievement)

1. Short-Term Goals (1-2 Years)

- Build an emergency fund with 3-6 months of living expenses

- Pay off high-interest debt (credit cards, personal loans)

- Save for a major purchase (vacation, new car, etc.)

- Improve credit score

2. Medium-Term Goals (3-5 Years)

- Save for a home down payment

- Invest in higher education or skill development

- Start a business or side hustle

- Maximize retirement savings

- Increase investment portfolio

Step 3: Create a Budget and Savings Plan

Budgeting is essential to allocate funds effectively and ensure you’re saving enough to reach your goals. Consider these budgeting methods:

1. The 50/30/20 Rule

- 50% Needs: Rent, utilities, groceries, insurance

- 30% Wants: Entertainment, dining out, hobbies

- 20% Savings: Emergency fund, retirement, investments

2. Automate Savings

Set up automatic transfers to your savings and investment accounts to ensure consistency.

3. Cut Unnecessary Expenses

- Reduce dining out and entertainment costs

- Cancel unused subscriptions

- Negotiate bills and insurance premiums

- Buy in bulk and use coupons

Step 4: Manage and Reduce Debt

Debt management is crucial for financial stability. Here’s how to tackle debt effectively:

1. Prioritize High-Interest Debt

- Focus on paying off credit cards and personal loans first

- Consider the debt snowball method (pay smallest debts first) or the debt avalanche method (pay highest interest debts first)

2. Consolidate or Refinance Loans

If possible, consolidate debts into a lower-interest loan or refinance existing loans to get better terms.

3. Avoid Accumulating New Debt

Only use credit for necessary purchases and pay balances in full each month.

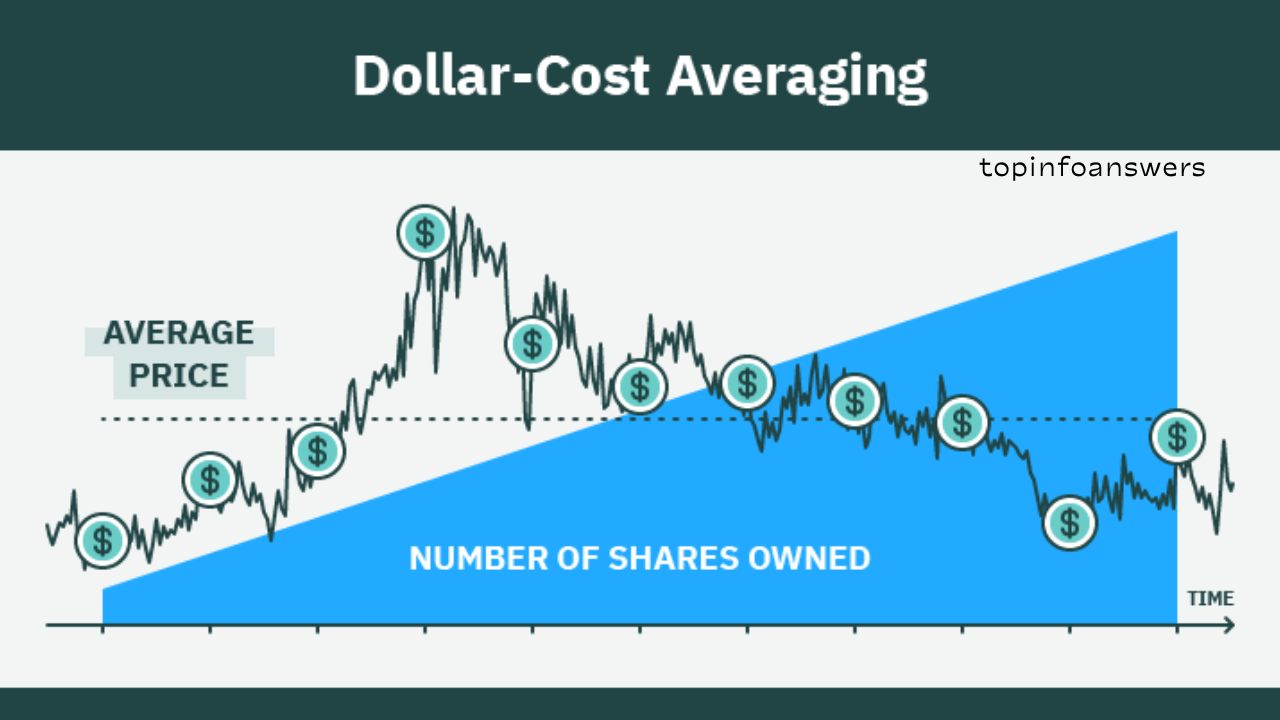

Step 5: Invest for Future Growth

Investing is key to growing wealth over the next five years. Consider these investment options:

1. Stock Market Investments

Invest in index funds, ETFs, or individual stocks based on risk tolerance and financial goals.

2. Real Estate

Buying property can be a great long-term investment, offering rental income and appreciation.

3. Retirement Accounts

Maximize contributions to 401(k), IRA, or Roth IRA accounts for long-term savings.

4. Side Hustles and Passive Income

Consider income streams like freelancing, blogging, affiliate marketing, or investing in dividend stocks.

Step 6: Plan for Major Life Events

Over the next five years, you may experience major life changes that require financial preparation.

1. Buying a Home

- Save for a down payment (typically 20%)

- Improve credit score for better mortgage rates

- Research home prices and financing options

2. Starting a Family

- Save for maternity/paternity leave expenses

- Plan for child-related costs (education, healthcare, daycare)

- Increase life insurance coverage

3. Career Changes or Business Ventures

- Build a financial cushion before making career transitions

- Save capital for starting a business

- Network and enhance skills for career growth

Step 7: Protect Your Finances

1. Insurance Coverage

Ensure you have the right insurance policies:

- Health Insurance

- Life Insurance

- Disability Insurance

- Homeowners/Renters Insurance

2. Estate Planning

- Draft a will to outline asset distribution

- Assign a power of attorney for financial decisions

- Consider setting up a trust for family wealth transfer

Step 8: Monitor and Adjust Your Plan

Regularly review and adjust your financial goals based on changes in income, expenses, or unexpected life events.

1. Conduct Annual Financial Reviews

Check progress toward your goals and make necessary adjustments.

2. Seek Professional Advice

Consult financial advisors, tax professionals, or investment experts to optimize your strategy.

Planning your financial goals for the next five years requires discipline, commitment, and continuous assessment. By assessing your current financial situation, setting clear goals, budgeting effectively, managing debt, investing wisely, and protecting your assets, you can create a solid financial foundation for a prosperous future. Start today, stay focused, and watch your financial dreams turn into reality.