In today’s dynamic economy, relying on a single income source can be risky. Many individuals and entrepreneurs are turning to multiple income streams to build financial stability, enhance wealth, and create a safety net against unexpected financial downturns. However, managing multiple sources of income effectively requires strategy, organization, and discipline. This guide explores the best practices for balancing different revenue sources while maximizing efficiency and profitability.

Benefits of Multiple Income Streams

1. Financial Security

Having multiple sources of income reduces dependency on a single paycheck. If one stream fails, others can help cover expenses, providing financial stability.

2. Increased Wealth-Building Opportunities

Different income streams allow you to accumulate wealth faster. By reinvesting profits from various sources, you can enhance your net worth over time.

3. Greater Flexibility

With diverse income sources, you can choose where to allocate your time and effort, making career transitions easier and allowing for more freedom in decision-making.

4. Enhanced Skill Development

Managing multiple income streams often requires learning new skills such as budgeting, marketing, and business management, which can contribute to personal and professional growth.

Types of Income Streams

There are various ways to diversify income, broadly categorized into active and passive income sources.

1. Active Income Streams

These require continuous effort and time to generate revenue.

- Full-time Job – A traditional source of income providing financial stability.

- Freelancing – Offering specialized skills like writing, graphic design, or consulting.

- Side Businesses – Running small businesses, such as e-commerce or dropshipping.

- Contract Work – Short-term projects that bring in additional earnings.

2. Passive Income Streams

These generate earnings with minimal ongoing effort.

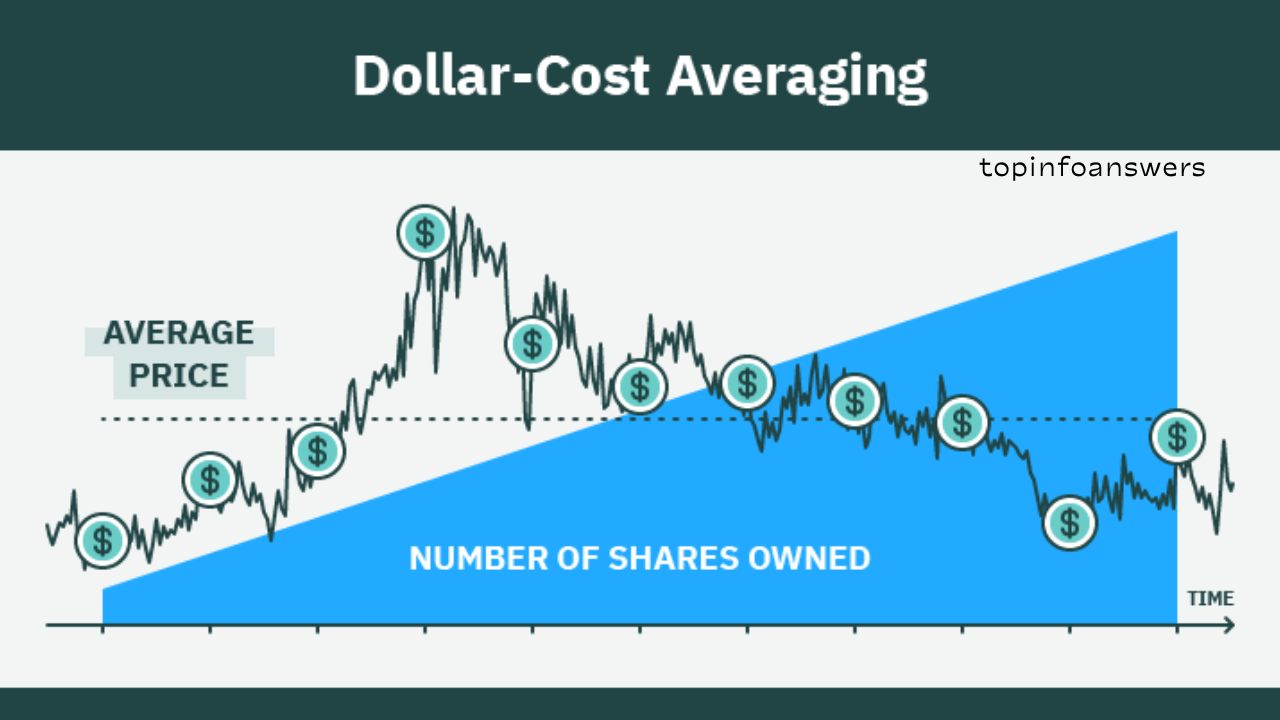

- Investments – Stocks, bonds, and mutual funds provide long-term financial growth.

- Real Estate – Rental properties or real estate investments generate recurring income.

- Royalties – Earnings from books, music, or intellectual property.

- Affiliate Marketing – Commissions from promoting products or services.

- Digital Products – Selling e-books, courses, or printables online.

Strategies to Manage Multiple Income Streams Effectively

1. Create a Structured Plan

Developing a clear roadmap for handling different income sources ensures efficiency. Identify your main revenue streams, set income goals, and establish timelines for managing each source.

2. Time Management and Prioritization

Balancing multiple streams requires effective time management. Use tools like planners, calendars, and productivity apps to allocate time wisely. Prioritize high-income activities while automating or outsourcing lower-value tasks.

3. Separate and Track Finances

Keeping separate accounts for each income stream helps track earnings and expenses accurately. Use financial management tools or software like QuickBooks, Mint, or Excel spreadsheets to monitor cash flow.

4. Automate Income and Expenses

Automation simplifies financial management. Set up direct deposits, scheduled bill payments, and automated investments to reduce manual tasks and prevent missed deadlines.

5. Diversify but Avoid Overcommitment

While having multiple income streams is beneficial, overcommitting can lead to burnout and inefficiency. Focus on a few well-managed streams before expanding further.

6. Utilize Tax Planning Strategies

Managing multiple income sources comes with tax implications. Consult a financial advisor or tax professional to optimize deductions, file accurate tax returns, and avoid penalties.

7. Reinvest Profits for Growth

Reinvesting a portion of earnings into expanding income streams or building new ones can increase long-term wealth. Consider reinvesting in skill development, business expansion, or passive income opportunities.

8. Establish an Emergency Fund

An emergency fund acts as a buffer during financial downturns. Set aside savings to cover at least three to six months’ worth of expenses.

9. Outsource and Delegate

To prevent burnout, delegate repetitive tasks. Hiring virtual assistants, accountants, or freelancers can free up time to focus on high-impact activities.

10. Monitor and Adjust Regularly

Regularly evaluate income streams to identify which ones are performing well and which need adjustments. Adapt strategies based on changing financial goals and market conditions.

Tools for Managing Multiple Income Streams

Using the right tools can make managing multiple income streams easier. Here are some useful resources:

Financial Management Tools

- QuickBooks – For tracking income and expenses.

- Mint – Helps with budgeting and financial planning.

- YNAB (You Need a Budget) – Assists with expense tracking and savings.

Productivity and Time Management Apps

- Trello/Asana – For task and project management.

- Google Calendar – Helps schedule and organize tasks efficiently.

- RescueTime – Tracks time spent on different activities.

Investment and Wealth Management Platforms

- Robinhood – For stock market investments.

- Betterment – Helps with automated investing.

- Fundrise – Facilitates real estate investments.

Tax and Accounting Tools

- TurboTax – For tax filing and preparation.

- H&R Block – Provides tax guidance and filing assistance.

Overcoming Common Challenges

1. Time Constraints

Managing multiple sources of income can be overwhelming. Solution: Prioritize income-generating activities and set realistic schedules.

2. Inconsistent Earnings

Freelancers and business owners may experience fluctuating incomes. Solution: Maintain a steady cash reserve and diversify income streams.

3. Burnout and Stress

Handling multiple commitments can be exhausting. Solution: Take regular breaks, set boundaries, and outsource non-essential tasks.

4. Legal and Tax Compliance Issues

Different income sources may have varying tax implications. Solution: Work with tax professionals to ensure compliance.

Effectively managing multiple income streams requires organization, time management, and financial planning. By leveraging tools, prioritizing tasks, and continuously evaluating income sources, individuals can achieve financial stability and growth. Whether you are a freelancer, entrepreneur, or investor, adopting these strategies will help you maximize earnings and build long-term wealth.