In today’s fast-paced world, managing personal finances effectively has become increasingly important. With rising living costs and fluctuating expenses, keeping track of where your money goes is crucial. Budgeting apps have emerged as powerful tools to help individuals and families monitor their spending, save more efficiently, and achieve their financial goals.

By leveraging the features of budgeting apps, you can gain insights into your spending patterns, automate savings, and make more informed financial decisions. This article will guide you through how to use budgeting apps for smarter spending, helping you take control of your finances and build a more secure future.

Understanding Budgeting Apps

What Are Budgeting Apps?

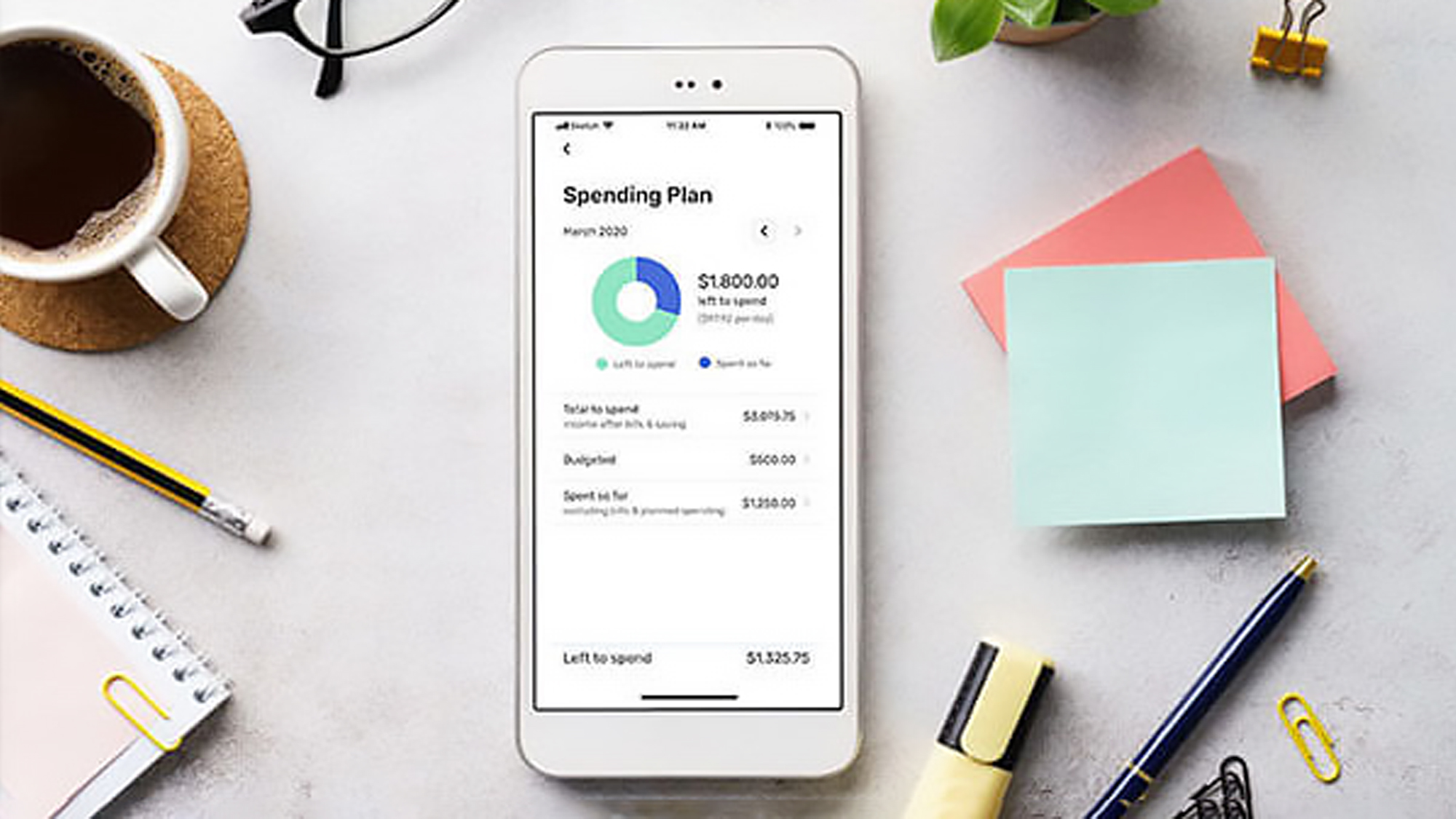

Budgeting apps are financial management tools designed to help individuals and households track their income, expenses, and savings. These apps provide users with a detailed overview of their financial activities by categorizing spending, setting spending limits, and providing reports.

Budgeting apps are typically available on smartphones, tablets, and desktop computers, making them easily accessible and convenient for daily use.

How Do Budgeting Apps Work?

Budgeting apps work by connecting to your bank accounts, credit cards, and sometimes even investment accounts. They automatically categorize your transactions, allowing you to view and analyze your spending patterns.

Some apps also offer features like:

- Goal setting: Helps you set and track financial goals (e.g., saving for a vacation or paying off debt).

- Spending limits: Allows you to set caps on specific categories, such as dining, entertainment, or shopping.

- Automatic alerts: Sends notifications when you approach or exceed your budget limits.

- Reports and analytics: Provides detailed visual reports of your financial habits.

Benefits of Using Budgeting Apps

✅ 1. Real-Time Expense Tracking

One of the biggest advantages of using budgeting apps is real-time expense tracking. Unlike manual methods, these apps automatically record transactions as they happen, giving you an up-to-date view of your spending. This helps you make informed decisions and adjust your expenses accordingly.

✅ 2. Categorization of Spending

Budgeting apps automatically categorize your expenses into specific groups, such as groceries, utilities, entertainment, and transportation. This helps you understand where the majority of your money is going and identify areas where you can cut back.

✅ 3. Automated Bill Payments and Reminders

Many budgeting apps offer bill payment scheduling and reminders, preventing you from missing due dates. This feature helps you avoid late fees, maintain a good credit score, and stay on top of recurring payments.

✅ 4. Improved Financial Awareness

By regularly reviewing your spending habits, you develop a deeper understanding of your financial health. Budgeting apps make it easier to recognize unnecessary expenses, identify areas for improvement, and stick to your financial goals.

Choosing the Right Budgeting App

🔍 1. Features to Look for

When selecting a budgeting app, consider the following features:

- Ease of use: A user-friendly interface is essential for seamless navigation.

- Synchronization with bank accounts: Choose an app that integrates easily with your financial institutions for real-time tracking.

- Expense categorization: Apps that automatically categorize expenses save time and provide valuable insights.

- Customizable budgets: The ability to set and adjust spending limits by category is crucial.

- Goal tracking: Look for apps that allow you to set and monitor financial goals.

- Reports and analytics: Detailed reports provide insights into spending trends and areas for improvement.

- Security features: Ensure the app uses encryption and multi-factor authentication for data protection.

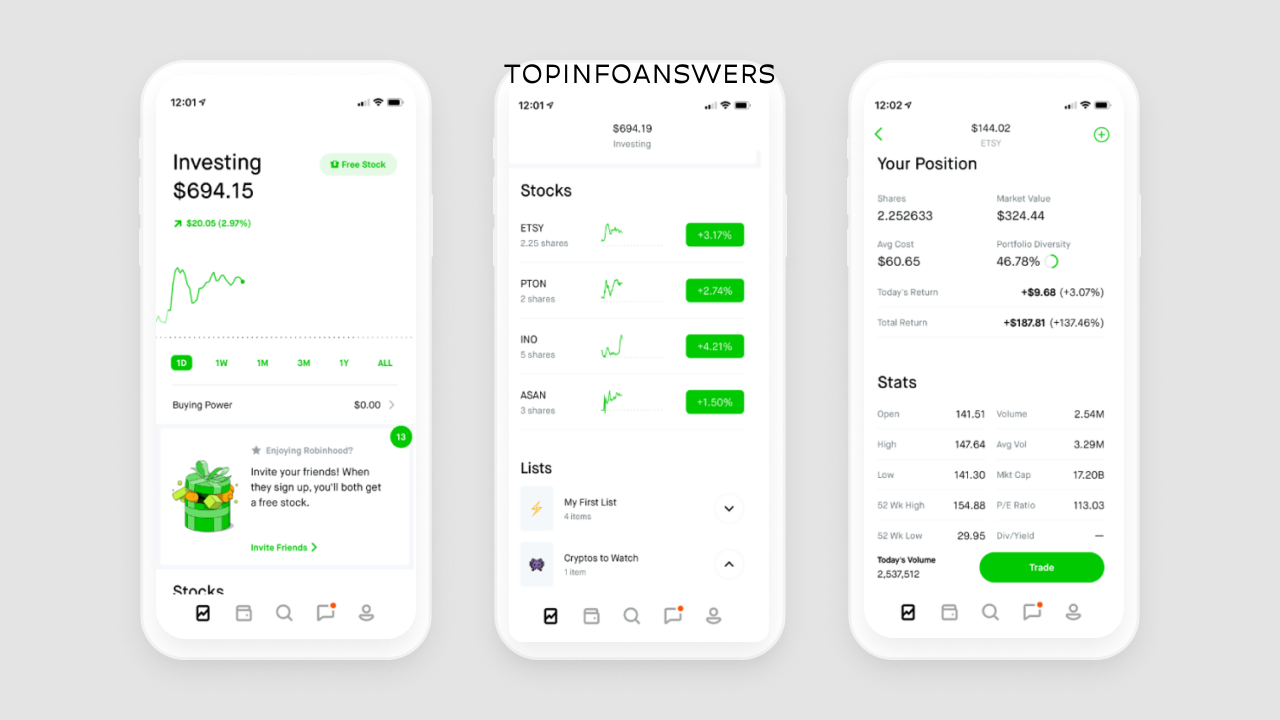

⭐ 2. Popular Budgeting Apps

Some of the most popular and reliable budgeting apps include:

- YNAB (You Need a Budget) – Ideal for detailed financial planning and debt management.

- Mint – A free app with real-time tracking, categorization, and goal-setting features.

- PocketGuard – Helps prevent overspending by showing how much disposable income you have.

- GoodBudget – Uses the envelope budgeting method, ideal for manual expense tracking.

- EveryDollar – Created by financial expert Dave Ramsey, this app focuses on zero-based budgeting.

- Honeydue – Designed for couples to track joint expenses and manage shared finances.

How to Use Budgeting Apps Effectively

🛠️ 1. Setting Up the App

- Download and install the app of your choice from the App Store or Google Play.

- Link your bank accounts, credit cards, and any other financial accounts.

- Set up authentication methods for security, such as PIN codes or biometric verification.

🎯 2. Defining Financial Goals

- Identify your short-term and long-term financial goals (e.g., saving for a car, building an emergency fund, or paying off debt).

- Use the app’s goal-setting feature to track your progress.

- Assign specific amounts to each goal and set deadlines.

📊 3. Creating and Managing Categories

- Categorize your expenses into groups like housing, groceries, transportation, entertainment, and personal care.

- Set spending limits for each category based on your monthly income and financial goals.

- Regularly review and adjust your categories as needed.

💾 4. Automating Savings

- Set up automatic transfers from your checking account to your savings account.

- Use the round-up feature (available in some apps) to round up transactions and save the difference.

- Utilize auto-saving rules to consistently set aside money toward your goals.

Tips for Smarter Spending with Budgeting Apps

💡 1. Monitor Subscriptions

Budgeting apps help identify recurring subscriptions and services. Regularly review your subscriptions and cancel any unused or unnecessary ones.

💡 2. Use Spending Limits

Set spending limits for discretionary categories like dining out, entertainment, and shopping. Apps with real-time alerts can notify you when you’re nearing or exceeding your budget.

💡 3. Identify and Eliminate Unnecessary Expenses

Use the insights from your app to spot wasteful spending habits. For example:

- If you notice frequent spending on coffee, consider making coffee at home.

- Identify expensive takeout meals and try cooking at home instead.

💡 4. Take Advantage of Analytics and Reports

Use the app’s analytics and visual reports to gain insights into your spending trends. This allows you to make data-driven decisions, adjust your budget, and prioritize essential expenses.

Common Mistakes to Avoid When Using Budgeting Apps

- Not updating transactions: Failing to sync or update your transactions can result in inaccurate data.

- Ignoring app notifications: Budgeting apps often send alerts for overspending or upcoming bills. Ignoring them can lead to financial mismanagement.

- Setting unrealistic budgets: Be realistic when setting your spending limits to avoid frustration and stay motivated.

- Over-relying on the app: While budgeting apps are helpful, it’s important to manually review your finances occasionally.

- Neglecting manual expenses: Some cash transactions might not be automatically tracked. Always add manual expenses to maintain accuracy.

Privacy and Security Considerations

When using budgeting apps, it is essential to prioritize privacy and security:

- Choose trusted apps: Opt for well-known and reputable apps with strong user reviews.

- Enable two-factor authentication: Adds an extra layer of security to protect your financial data.

- Review app permissions: Only allow necessary access to your financial information.

- Keep the app updated: Regular updates include security patches that protect against vulnerabilities.

Budgeting apps are powerful tools that can help you spend smarter, save effectively, and reach your financial goals. By tracking your expenses, setting limits, and identifying unnecessary spending, these apps empower you to take control of your finances.

To maximize the benefits of budgeting apps:

- Choose the right app that suits your needs.

- Set realistic goals and spending limits.

- Regularly review your financial reports and adjust your budget as needed.

By making budgeting apps a regular part of your financial routine, you can develop healthier spending habits and build a more secure financial future. 💡💰