Investing in bonds is a great way to generate steady income, preserve capital, and diversify your investment portfolio. Bonds are considered a safer investment compared to stocks, making them a preferred choice for risk-averse investors. In this comprehensive guide, we will explore everything you need to know about investing in bonds for reliable returns.

Understanding Bonds

Bonds are fixed-income securities that represent a loan made by an investor to a borrower, typically a corporation, municipality, or government. When you invest in bonds, you are essentially lending money in exchange for periodic interest payments and the return of the principal amount at maturity.

Key Components of Bonds

- Face Value (Par Value): The amount the bondholder will receive at maturity.

- Coupon Rate: The interest rate paid to the bondholder, usually on a semiannual basis.

- Maturity Date: The date on which the issuer repays the bond’s face value.

- Issuer: The entity issuing the bond (government, corporations, or municipalities).

- Yield: The return an investor can expect from the bond based on its purchase price and coupon payments.

Types of Bonds

1. Government Bonds

Government bonds are issued by national governments and are considered low-risk investments.

- U.S. Treasury Bonds: Backed by the U.S. government, they are among the safest investments.

- Municipal Bonds: Issued by state or local governments; often tax-free.

- Sovereign Bonds: Issued by foreign governments.

2. Corporate Bonds

Corporations issue bonds to raise capital for operations or expansion.

- Investment-Grade Bonds: Issued by financially stable companies and offer lower yields but lower risk.

- High-Yield (Junk) Bonds: Issued by companies with lower credit ratings and offer higher yields to compensate for higher risk.

3. Agency Bonds

These are issued by government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac.

4. Convertible Bonds

These bonds can be converted into a predetermined number of company shares, offering the potential for higher returns.

How to Achieve Financial Independence and Retire Early (FIRE Movement)

5. Zero-Coupon Bonds

These do not pay periodic interest but are issued at a deep discount and pay the full face value at maturity.

Why Invest in Bonds?

1. Reliable Income

Bonds provide predictable interest payments, making them ideal for income-focused investors.

2. Capital Preservation

Unlike stocks, bonds return the principal amount at maturity, helping preserve capital.

3. Portfolio Diversification

Bonds reduce overall portfolio risk by providing stability during market downturns.

4. Tax Advantages

Municipal bonds offer tax-free interest income, benefiting high-income investors.

How to Invest in Bonds

1. Determine Your Investment Goals

Understand why you are investing in bonds—whether it’s for income, diversification, or capital preservation.

2. Choose the Right Type of Bonds

Select bonds based on risk tolerance, time horizon, and financial goals.

3. Consider Bond Ratings

Ratings from agencies like Moody’s, S&P, and Fitch indicate the creditworthiness of bond issuers:

- AAA to BBB (Investment-Grade): Lower risk, lower returns.

- BB to D (High-Yield/Junk Bonds): Higher risk, higher returns.

4. Decide Between Individual Bonds and Bond Funds

- Buying Individual Bonds: Provides control over maturity and interest payments but requires research.

- Bond Mutual Funds and ETFs: Offer diversification and professional management but have management fees.

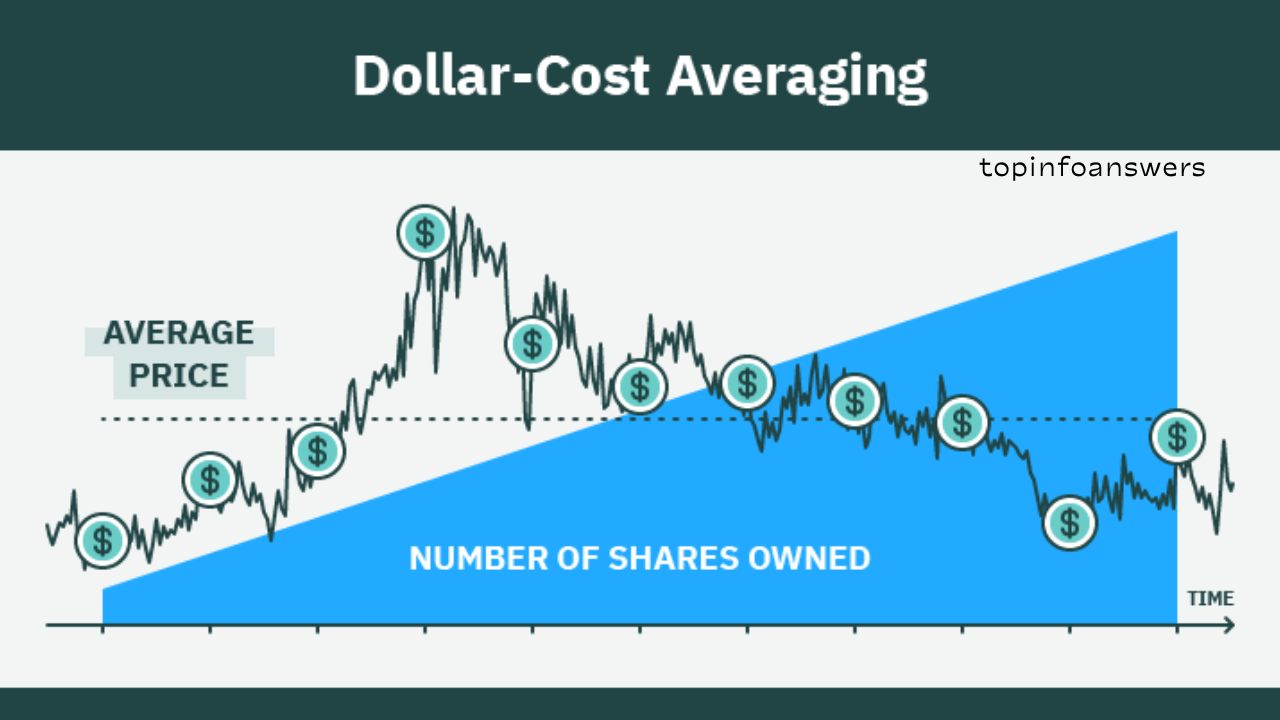

5. Understand Interest Rate Risk

When interest rates rise, bond prices fall. Consider duration and yield curve when selecting bonds.

6. Diversify Your Bond Holdings

Investing in different types of bonds (government, corporate, municipal) reduces risk.

7. Buy Bonds Through Different Channels

- Brokerage Firms: Provide access to various bond types.

- TreasuryDirect: Allows investors to buy U.S. Treasury bonds directly.

- Bond Mutual Funds and ETFs: Offer a diversified approach.

Strategies for Maximizing Returns

1. Laddering Strategy

Invest in bonds with different maturities to manage interest rate risk and ensure liquidity.

2. Barbell Strategy

Hold short-term and long-term bonds but avoid intermediate-term bonds to balance risk and return.

3. Bullet Strategy

Invest in bonds with the same maturity to take advantage of a specific future need.

4. Active Bond Trading

Buy and sell bonds based on market conditions to optimize returns.

Risks of Bond Investing

1. Interest Rate Risk

Bond prices drop when interest rates rise.

2. Credit Risk

Issuer default may result in loss of principal and interest.

3. Inflation Risk

Rising inflation can erode purchasing power of fixed interest payments.

4. Liquidity Risk

Some bonds may be difficult to sell at desired prices.

How to Plan Your Financial Future Without Sacrificing Comfort

Investing in bonds can be a reliable way to generate steady income and preserve capital. By understanding bond types, risks, and investment strategies, you can make informed decisions that align with your financial goals. Whether you choose government bonds for safety, corporate bonds for higher yields, or municipal bonds for tax advantages, a well-diversified bond portfolio can provide stability and consistent returns.