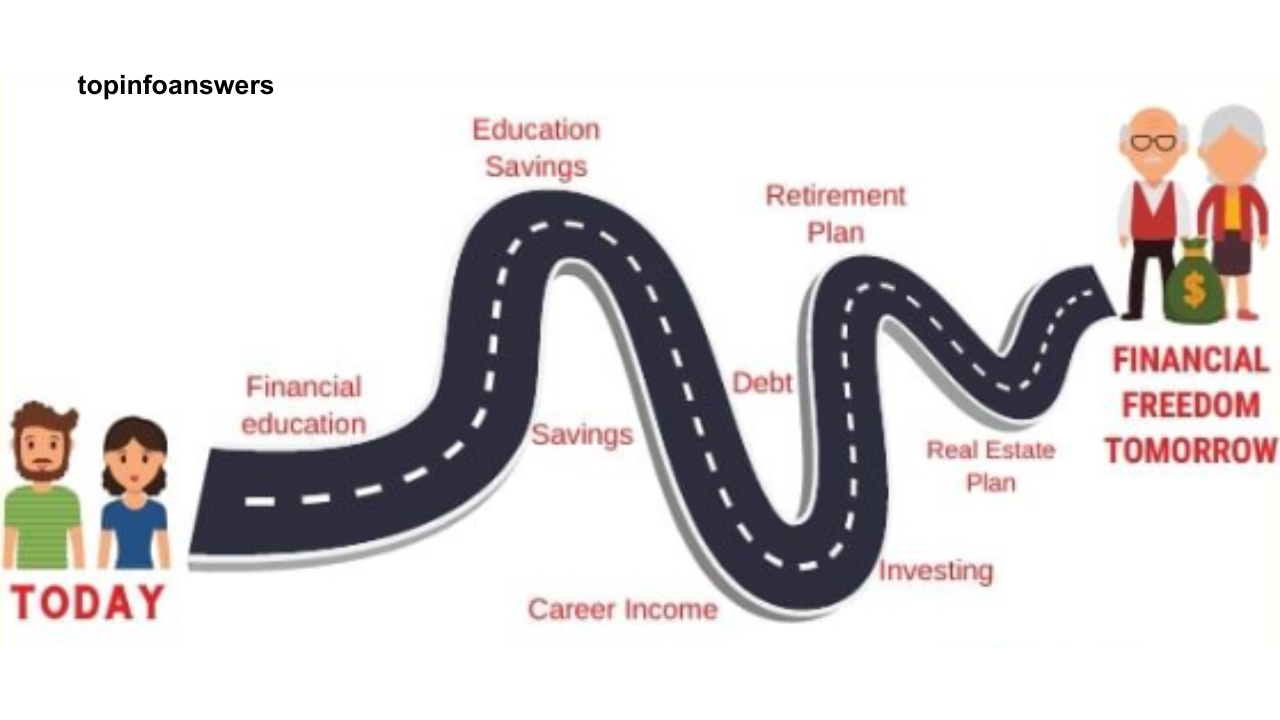

A well-structured financial plan is crucial for achieving financial security and long-term success. Whether you want to buy a house, start a business, save for retirement, or travel the world, a financial plan helps you allocate resources efficiently and stay on track. This guide will take you through the step-by-step process of creating a financial plan that aligns with your personal and professional goals.

Step 1: Define Your Financial Goals

Setting clear, specific, and measurable goals is the foundation of any financial plan. Your goals can be classified into three categories:

- Short-Term Goals (1-3 years): Examples include building an emergency fund, paying off credit card debt, or saving for a vacation.

- Medium-Term Goals (3-10 years): Examples include buying a house, starting a business, or investing in education.

- Long-Term Goals (10+ years): Examples include retirement planning, building generational wealth, or purchasing real estate.

Ensure your goals follow the SMART criteria:

- Specific – Clearly define what you want to achieve.

- Measurable – Set quantifiable targets.

- Achievable – Make sure the goals are realistic.

- Relevant – Align goals with your lifestyle and values.

- Time-bound – Assign a deadline for achieving them.

Step 2: Assess Your Current Financial Situation

Understanding where you currently stand financially is essential for creating a realistic financial plan. This involves evaluating your:

- Income: Calculate your total income from all sources, including salary, investments, and side businesses.

- Expenses: Categorize your expenses into fixed (rent, mortgage, insurance) and variable (entertainment, dining out).

- Assets: List your assets, including savings, investments, real estate, and personal property.

- Liabilities: Identify your debts, including student loans, credit card balances, and mortgages.

By calculating your net worth (Assets – Liabilities), you can gain a clearer picture of your financial health.

Step 3: Create a Budget That Aligns with Your Goals

A budget is a critical tool for managing your finances. It ensures that you allocate money toward your goals while controlling unnecessary spending. Follow these steps to create an effective budget:

- Track Your Spending – Use apps like Mint, YNAB, or Excel sheets to monitor your expenses.

- Identify Areas to Cut Costs – Reduce discretionary expenses like eating out, subscriptions, and impulse purchases.

- Allocate Funds to Savings & Investments – Follow the 50/30/20 rule:

- 50% for necessities (rent, groceries, utilities)

- 30% for discretionary spending (entertainment, hobbies)

- 20% for savings and investments

Adjust these percentages based on your financial priorities.

Step 4: Build an Emergency Fund

An emergency fund acts as a financial cushion in case of unexpected expenses like medical bills, job loss, or car repairs. Aim to save at least 3-6 months’ worth of living expenses in a high-yield savings account. This fund prevents you from dipping into your long-term investments during financial hardships.

Step 5: Manage Debt Strategically

Debt can hinder financial progress if not managed properly. Use these strategies to eliminate or control debt:

- Debt Snowball Method – Pay off the smallest debts first while making minimum payments on larger ones.

- Debt Avalanche Method – Focus on paying off high-interest debts first to save on interest.

- Refinancing & Debt Consolidation – Consider refinancing loans or consolidating debts for better interest rates.

- Avoid High-Interest Debt – Reduce reliance on credit cards and payday loans.

Step 6: Invest for the Future

Investing is essential for wealth-building and financial security. Depending on your risk tolerance and goals, consider these investment options:

- Stocks & Mutual Funds – Ideal for long-term growth.

- Bonds – Provide stability and regular income.

- Real Estate – Offers passive income and capital appreciation.

- Retirement Accounts (401k, IRA, PPF) – Tax-advantaged accounts to grow retirement savings.

- Cryptocurrency & Alternative Investments – Higher risk but potential high rewards.

Diversify your investments to balance risk and reward effectively.

Step 7: Plan for Retirement

Retirement planning should start as early as possible to maximize compound interest. Steps to secure your retirement include:

- Determine Retirement Needs – Estimate how much you will need based on lifestyle expectations.

- Maximize Employer Contributions – Take full advantage of employer-matched retirement plans.

- Automate Retirement Savings – Set up automatic contributions to your retirement account.

- Review & Adjust Investments – Shift towards lower-risk investments as you approach retirement.

Step 8: Protect Your Wealth with Insurance

Insurance safeguards your financial stability in case of unforeseen events. Consider the following insurance policies:

- Health Insurance – Covers medical expenses.

- Life Insurance – Provides financial security for dependents.

- Disability Insurance – Replaces income in case of disability.

- Home & Auto Insurance – Protects property and vehicles.

- Liability Insurance – Shields assets from lawsuits.

Step 9: Estate Planning

Estate planning ensures your wealth is distributed according to your wishes. Key components include:

- Will & Testament – Specifies asset distribution.

- Power of Attorney – Appoints someone to manage finances if you become incapacitated.

- Trusts – Helps in tax-efficient wealth transfer.

- Beneficiary Designations – Ensure insurance policies and accounts have correct beneficiaries.

Step 10: Review and Adjust Your Financial Plan Regularly

Financial planning is not a one-time task. Life events like marriage, children, job changes, and economic shifts may require adjustments. Conduct a financial review annually to:

- Assess goal progress.

- Adjust budgets based on income changes.

- Rebalance investment portfolios.

- Update insurance policies and estate plans.

Creating a financial plan that supports your goals requires clarity, discipline, and regular adjustments. By setting clear goals, budgeting wisely, saving diligently, investing strategically, and protecting your assets, you can achieve financial freedom and long-term stability. Start today and make your financial future a priority!