How to Create a Financial Plan That Supports Your Goals

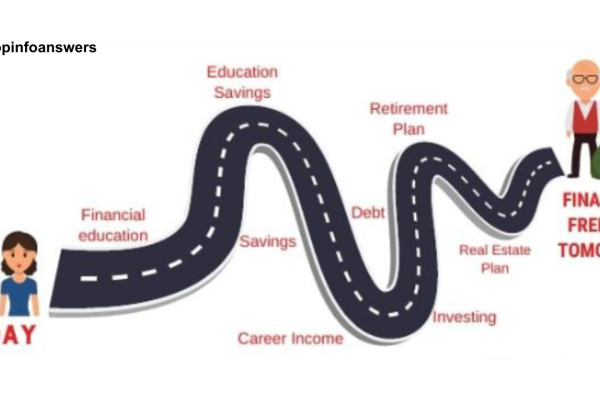

A well-structured financial plan is crucial for achieving financial security and long-term success. Whether you want to buy a house, start a business, save for retirement, or travel the world, a financial plan helps you allocate resources efficiently and stay on track. This guide will take you through the step-by-step process of creating a financial…