How to Stay Financially Fit During Economic Uncertainty

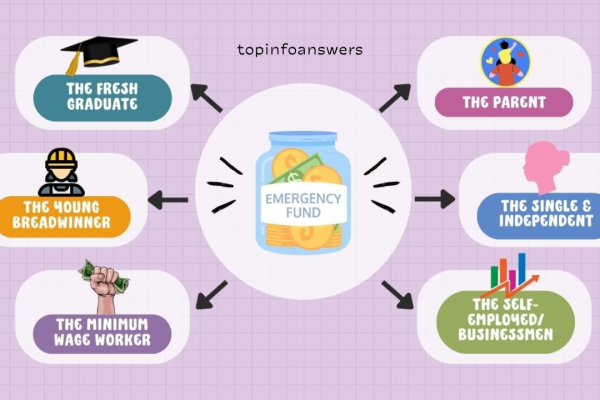

Economic uncertainty can arise from various factors, including recessions, inflation, global crises, and market fluctuations. During such times, financial stability becomes a major concern for individuals and families. Staying financially fit requires proactive planning, strategic decision-making, and adaptability. In this comprehensive guide, we will explore effective strategies to help you navigate economic downturns and safeguard…